45 zero coupon bonds tax

How is tax calculated on a zero coupon bond? - Quora Answer (1 of 5): Great question. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount a bond will be worth when it "matures" or comes due. When a zero coupon bond ... Understanding Zero Coupon Bonds - Part One - The Balance Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value. Some issuers may call zeros before maturity. You must pay tax on interest annually even though you don't receive it until maturity. Zero coupon bonds are more volatile than regular bonds.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills. Treasury Bills (T-Bills) Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up ...

Zero coupon bonds tax

Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it. Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero Coupon Municipal Bonds: Tax Treatment - TheStreet The question concerns tax-exempt zero-coupon municipal bonds. A regular bond pays interest on its face value, or principal, twice a year at a rate determined by its coupon. A bond with a face ...

Zero coupon bonds tax. What Is a Zero-Coupon Bond? | The Motley Fool Understanding zero-coupon bonds. Zero-coupon bonds make money by being sold to investors at substantial discounts to face value. Zero-coupon bonds compensate for not paying any interest over the ... Taxes and zero coupon bonds - FMSbonds.com Tax-exempt interest earned on zero coupon bonds should be reported on your 1040, along with all other tax-exempt interest received. The interest reported is based on the original issue price and yield or, as you stated, "the bond's original accretion." Your adjusted basis in the bonds at any time after purchase would be your actual purchase ... Impact of Taxation on Zero-Coupon Muni Returns Impact of Taxation on Zero-Coupon Munis. Taxation on zero-coupon munis is only realized upon their sale or maturity. If the bond is sold before its maturity, it is either sold at a discount or a premium in the secondary market. Any price paid above the adjusted issue price (discussed below) will be premium and any price below the adjusted issue ... Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. ... or purchasing the few corporate zero coupon bonds that have tax-exempt status. Featured ...

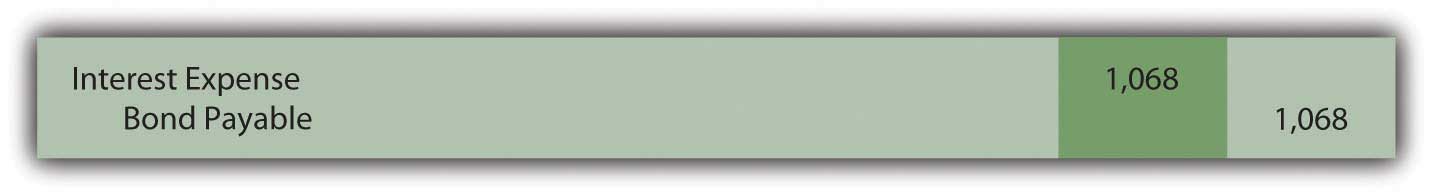

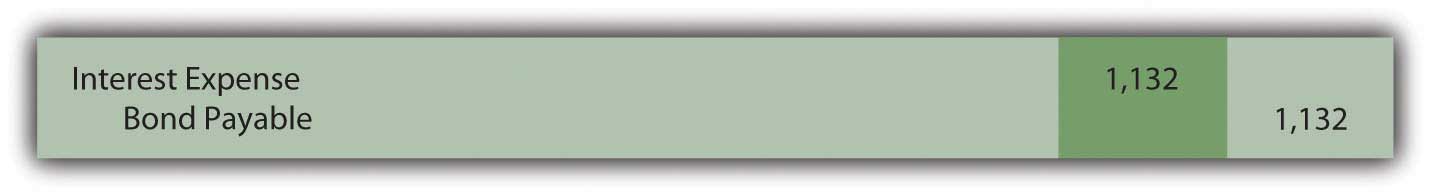

How are Bonds Taxed Under the Income Tax Act? - Wint Wealth Types of Bonds and Their Taxation . There are different types of bonds in the market. Let us look at their types and taxation. 1. Zero-Coupon Bonds . Zero-coupon bondholders are liable to only capital gain tax as they do not provide any interest income. However, these are issued at a discount. Hence, the difference is taxed as capital gain. 2. Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ... How to Buy Zero Coupon Bonds | Finance - Zacks But their income is exempt from federal and, in some cases, state and local taxes. Step 4. Contact your bank or broker with your zero coupon bond order. The bond selling price remains the same no ... 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate 3. The compounding of this interest raises the principal by $1,068 from $17,800 to $18,868. The balances to be reported in the financial statements at the end of Year One are as follows: Year One—Interest Expense (Income Statement) $1,068.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. Do you pay taxes on zero coupon bonds? - Quora Answer: Yes. When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be ... The ABCs of Zero Coupon Bonds | Tax & Wealth Management, LLP Let's say, a hypothetical zero coupon bond is issued today at a discount price of $743 with a face value of $1,000, payable in 15 years. If you buy this bond, hold it for the entire term and receive the face-value payment, the difference of $257 represents the interest you earned. In this hypothetical example, the bond's interest rate would ... Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia Zero-Coupon Bonds. A zero-coupon bond is a type of bond that earns no interest during its lifetime. A zero-coupon bond is issued with a sudden reduction in par value or face value, which is the amount that will be paid for the bond at maturity. An investor receives a one-time interest payment at maturity equal to the difference between the face ...

Zero Coupon Bonds- Taxability under Income Tax Act, 1961 The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - "Zero Coupon bond" means a bond: - (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005

Solved: Zero coupon municipal bonds maturation In 1994, I purchased zero coupon municipal bonds. Over the years, tax free municipal bond interest has been imputed annually as the market value of the bonds increased. These bonds matured in 2018 and my broker reported the maturation value on my 1099B. As a result, it appears that I sold securities for proceeds of $115K all at once.

Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax. As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond-. (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

TAXABILITY OF ZERO COUPON BONDS - The Tax Talk Zero coupon bonds, also known as discount bonds, are those which do not pay any interest to. the bondholders. These are issued at heavy discount and redeemed at par. The profit is the. difference between the buying price and face value. These are also called as Deep Discount. Bonds. As per section 2(48) of Income Tax Act, zero coupon bonds must ...

PDF Income Taxes on Zero Coupon Bonds (Preliminary Version) the tax free rate to the after tax rate of return is a common comparison in evaluating taxable and tax free investments. A zero coupon bond pays only at maturity and doesn't pay periodic interest. For a taxable zero coupon bond, the IRS requires that income taxes be paid annually as OID securities

Zero Coupon Bonds (ZCB) & its taxation in the hands of investor Zero Coupon Bond under the Income Tax Act-1961. There is specific definition given in the Income Tax Act-1961 in section 2(48). Section 2(48) of Income Tax Act, 1961 defines Zero Coupon Bonds reads as under: Unless the context otherwise requires, the term "zero coupon bond" means a bond-

Publication 1212 (01/2022), Guide to Original Issue Discount (OID ... It discusses the income tax rules for figuring and reporting OID on long-term debt instruments. It also includes a similar discussion for stripped bonds and coupons, such as zero coupon bonds available through the Department of the Treasury's STRIPS program and government-sponsored enterprises such as the Resolution Funding Corporation.

Taxation Rules for Bond Investors--A Taxing Issue Taxation of Zero-Coupon Bonds . ... The interest from these bonds is tax free at the federal, state and local levels, as long as investors reside in the same state or municipality as the issuers.

Zero Coupon Municipal Bonds: Tax Treatment - TheStreet The question concerns tax-exempt zero-coupon municipal bonds. A regular bond pays interest on its face value, or principal, twice a year at a rate determined by its coupon. A bond with a face ...

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

/GettyImages-656680302-b9ac142099da451e8fa31a60d9fa9a33.jpg)

Post a Comment for "45 zero coupon bonds tax"