42 duration of a coupon bond

Duration Formula (Definition, Excel Examples) | Calculate Duration of Bond Calculate the bond duration for the following annual coupon rate: (a) 8% (b) 6% (c) 4% Given, M = $100,000 n = 4 r = 10% Calculation for Coupon Rate of 8% Coupon payment (C)= 8% * $100,000 = $8,000 The denominator or the price of the bond is calculated using the formula as, Bond price = 88,196.16 Bond duration - Wikipedia The steps to compute duration are the following: 1. Estimate the bond value The coupons will be $50 in years 1, 2, 3 and 4. Then, on year 5, the bond will pay coupon and principal, for a total of $1050. Discounting to present value at 6.5%, the bond value is $937.66.

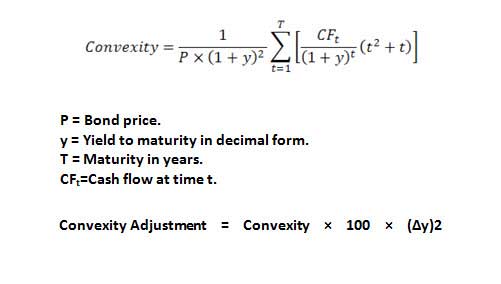

Duration and Convexity to Measure Bond Risk - Investopedia However, for zero-coupon bonds, duration equals time to maturity, regardless of the yield to maturity. The duration of level perpetuity is (1 + y) / y. For example, at a 10% yield, the duration of...

Duration of a coupon bond

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... Duration - Definition, Types (Macaulay, Modified, Effective) It is a measure of the time required for an investor to be repaid the bond's price by the bond's total cash flows. The Macaulay duration is measured in units of time (e.g., years). The Macaulay duration for coupon-paying bonds is always lower than the bond's time to maturity. For zero-coupon bonds, the duration equals the time to maturity. Macaulay Duration - Investopedia A coupon-paying bond will always have its duration less than its time to maturity. In the example above, the duration of 5.58 half-years is less than the time to maturity of six half-years. In...

Duration of a coupon bond. › terms › cCoupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Dollar Duration - Overview, Bond Risks, and Formulas Dollar Duration. The change in the price of the bond for every 100 bps (basis points) of change in the interest rate. Updated August 31, 2021. ... It means that as interest rates fall, bond coupon rates increase. Short-term bonds are less sensitive to interest changes, while a 20-year long-term bond may be more sensitive to interest rate ... How to Calculate the Price of Coupon Bond? - WallStreetMojo Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as, Understanding bond duration - Education | BlackRock It's lost some appeal (and value) in the marketplace. Duration is measured in years. Generally, the higher the duration of a bond or a bond fund (meaning the longer you need to wait for the payment of coupons and return of principal), the more its price will drop as interest rates rise. How duration affects the price of your bonds

Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. What Is Duration of a Bond? - TheStreet Definition - TheStreet For example, if interest rates rose by 2%, a 10-year Treasury with a coupon of 3.5% and a duration of 8.4 years would fall in value by 15%. Long-Term Bonds Let's use the 30-year Treasury with 4.5%... Duration of Bonds | Premium Bonds - PFhub Duration of the Two Basic Bond Types. Zero Coupon Bond: For a zero coupon bond, duration is the same as its maturity period. For a zero coupon bond, the fulcrum on the seesaw would be placed right under the bond's future value money bag at the maturity period (right most end of the plank), balancing its load right under. This is because the ...

Bond Duration Calculator - Macaulay and Modified Duration Coupon Payment Frequency - How often the bond pays interest per year. Calculator Outputs Yield to Maturity (%): The yield until the bond matures, as computed by the tool. See the yield to maturity calculator for more details. Macaulay Duration (Years) - The weighted average time (in years) for the bond's cash flows to pay out. What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Bond Duration | Formula | Excel | Example - XPLAIND.com As mentioned above, duration of a zero-coupon bond equals it outstanding term, while in other cases, it is less than the term of the debt instrument. Bond B is less risky than Bond C even though they have equal terms because it has higher coupon rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

How to Calculate Bond Duration - wikiHow To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder).

Bond Duration: What It Is and Why It Matters - Oblivious Investor A 5-year corporate bond with a higher yield will have an even shorter duration. For example, if sold for face value, a 5-year bond with a 5% coupon rate would have a duration of 4.49 years. Despite having the same maturity as the lower-yielding Treasury bond, it has a shorter duration. The reason for this is that a larger portion of the bond ...

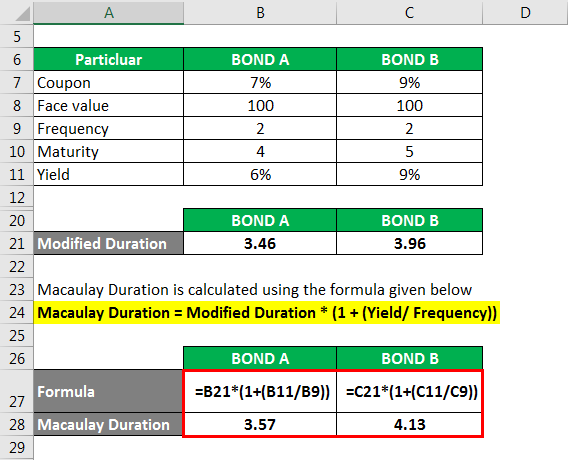

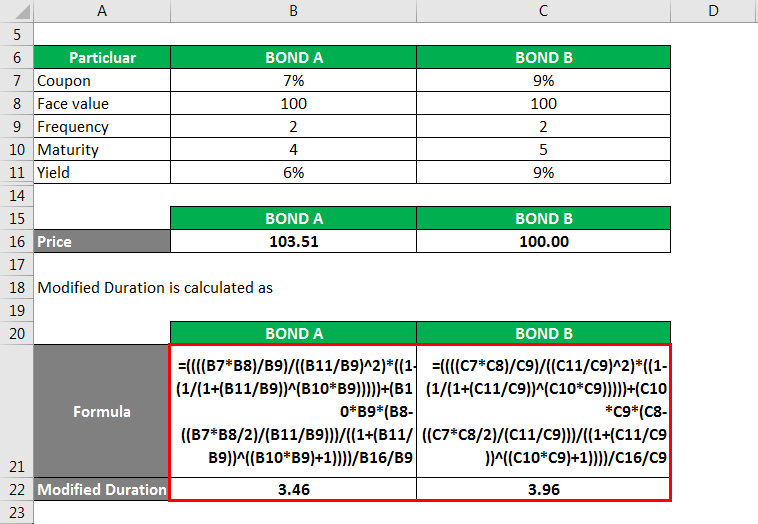

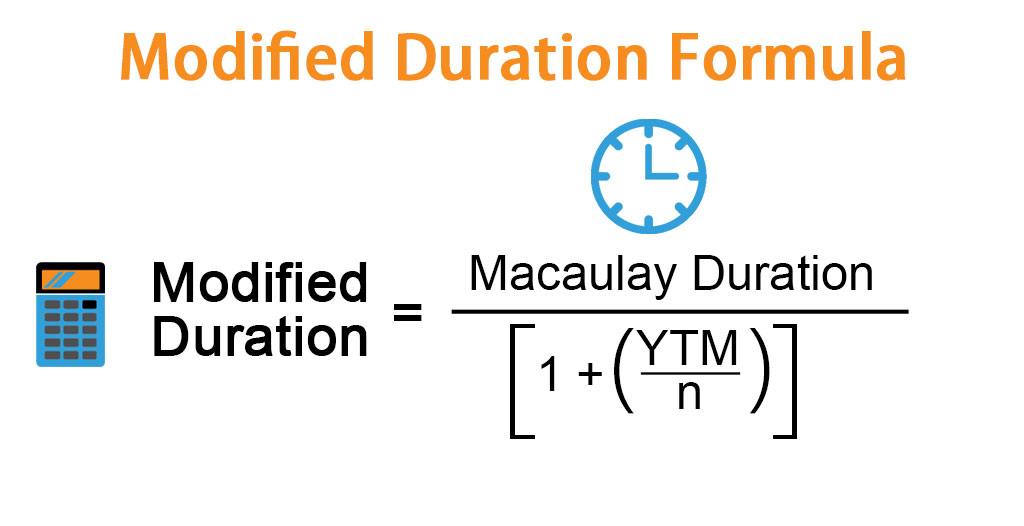

Duration Definition - Investopedia The modified duration of a bond with semi-annual coupon payments can be found with the following formula: ModD=\frac {\text {Macaulay Duration}} {1+\left (\frac {YTM} {2}\right)} M odD = 1+( 2Y T...

Bond Properties and Duration, Immunization.xlsx - Find the... What is the duration of a zero-coupon bond that would immunize your obligation and its future redemption value? Duration 1.4762 Future Redemption Value $ 21,375.74 You buy a zero-coupon bond with value and duration equal to your obligation. Now suppose that rates immediately increase to 11%.

Bond Duration Calculator - Exploring Finance PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years

Duration - NYU Stern For zero-coupon bonds, there is a simple formula relating the zero price to the zero rate. •We use this price-rate formula to get a formula for dollar duration.17 pages

› terms › mModified Duration Definition - Investopedia Feb 12, 2022 · Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates. Modified duration follows the concept that interest rates ...

Modified Duration - Overview, Formula, How To Interpret Below is an example of calculating Macaulay duration on a bond. Example of Macaulay Duration. Tim holds a 5-year bond with a face value of $1,000 and an annual coupon rate of 5%. The current rate of interest is 7%, and Tim would like to determine the Macaulay duration of the bond. The calculation is given below: The Macaulay duration for the 5 ...

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

› duration-bondWhat is the duration of a bond? and How to Calculate It? The duration of a bond does not represent the duration for which an investor holds a bond. Instead, it refers to the relationship between the price of a bond and interest rates of the bond after considering its different characteristics such as yield, coupon rate, maturity, etc.

Duration | Definition & Examples | InvestingAnswers The lower the coupon, the longer the duration (and volatility). Zero-coupon bonds - which have only one cash flow - have durations equal to their maturities. 2. Maturity. The longer a bond's maturity, the greater its duration and volatility. Duration changes every time a bond makes a coupon payment, shortening as the bond nears maturity.

How to Calculate the Bond Duration (example included) PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

Macaulay Duration - Investopedia A coupon-paying bond will always have its duration less than its time to maturity. In the example above, the duration of 5.58 half-years is less than the time to maturity of six half-years. In...

Duration - Definition, Types (Macaulay, Modified, Effective) It is a measure of the time required for an investor to be repaid the bond's price by the bond's total cash flows. The Macaulay duration is measured in units of time (e.g., years). The Macaulay duration for coupon-paying bonds is always lower than the bond's time to maturity. For zero-coupon bonds, the duration equals the time to maturity.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Post a Comment for "42 duration of a coupon bond"