43 zero coupon bonds risk

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Do zero-coupon bonds have interest rate risk? - Quora Which is considered to be risky a 10-year coupon bond or a 10-year zero coupon bond? It depends on what you mean by risk. The price of the zero is likely to be more volatile, but the total return you will earn if you hold it to maturity is known with 100% certainty. So there is interim price volatility, but no risk at all if you hold to maturity.

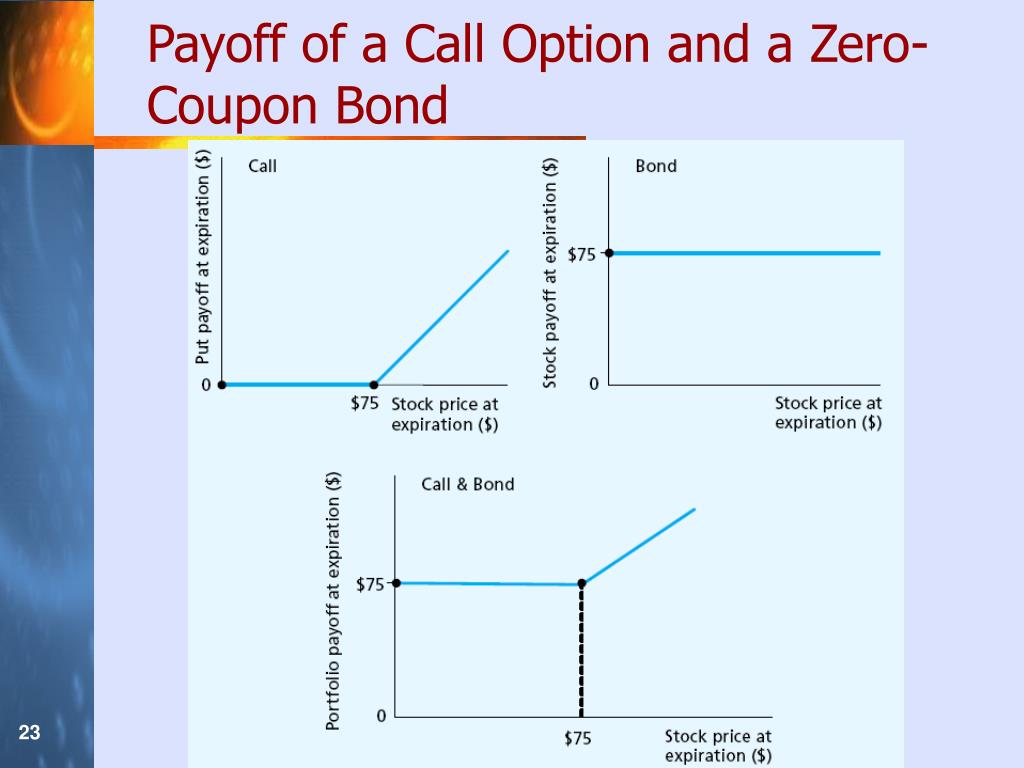

Default Risk and the Duration of Zero Coupon Bonds This paper applies a contingent claims approach to examine the duration of a zero coupon bond subject to default risk. One replicating portfolio for a default‐prone zero coupon bond contains a long position in the default‐free asset plus a short position in a put option on the underlying assets. The duration of the bond is shown to be a ...

Zero coupon bonds risk

Zero-coupon bonds news and analysis articles - Risk.net You are currently accessing Risk.net via your Enterprise account. If you already have an account please use the link below to sign in. If you have any problems with your access or would like to request an individual access account please contact our customer service team. Phone: 1+44 (0)870 240 8859. Email: Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds.

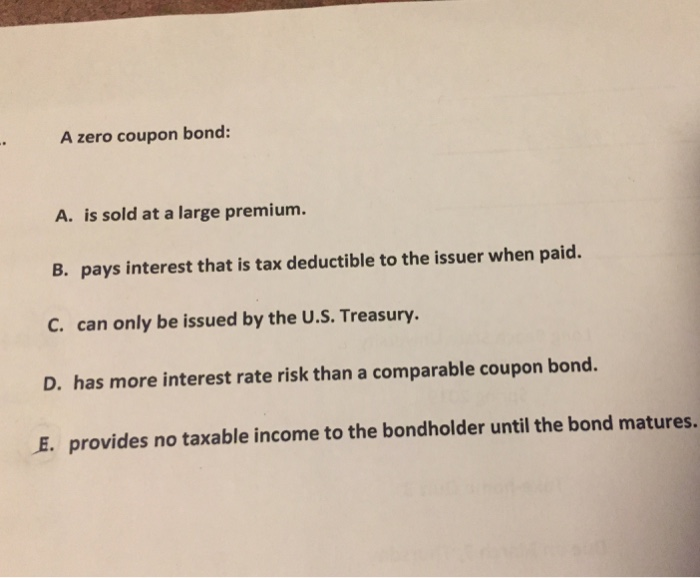

Zero coupon bonds risk. Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Risks Interest Rate Sensitivity One drawback to zero-coupon bonds is their pricing sensitivity based on the prevailing market interest rate conditions. Bond prices and interest rates have an "inverse" relationship with one another: Declining Interest Rates Higher Bond Prices Rising Interest Rates Lower Bond Prices What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia What is a Zero-Coupon Bond? Zero-coupon bond or ZCB is a financial instrument that does not pay any interest or coupon rate but is, instead, issued at a deep discount and is redeemed at face value on maturity. The return earned by the investor is the difference between the issue price and the redemption price. Yield to maturity of Zero-Coupon Bonds. Zero-Coupon Bonds can render great returns if used strategically for your investment goal. Zero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ...

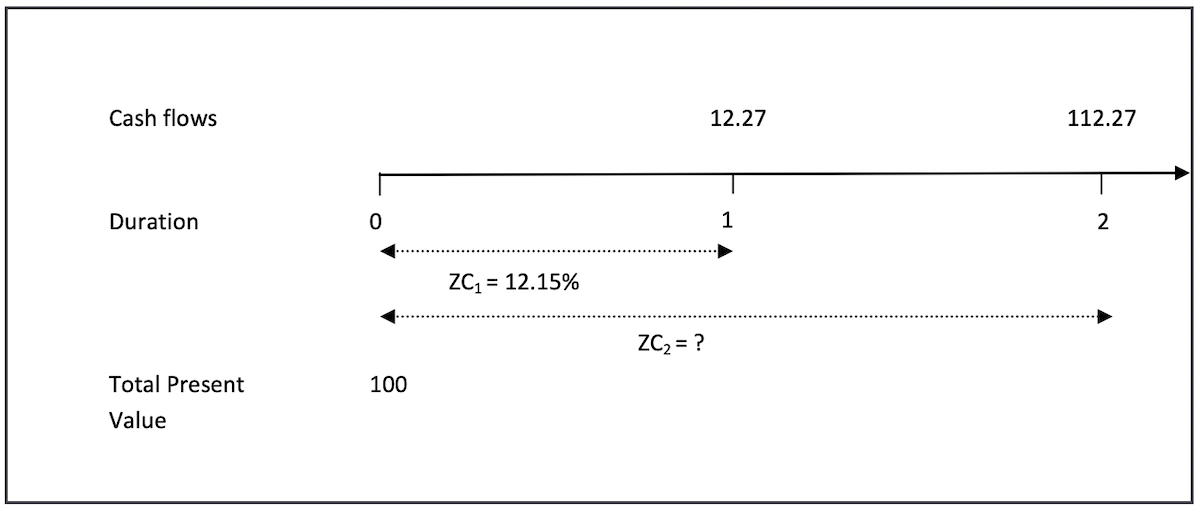

Mapping Zero-coupon Bonds to Risk Factors - Finance Train The first coupon is sensitive to the 6-month interest rate, the next coupon is sensitive to the one-year interest rate, and the last (10th) payment will be sensitive to the 5-year zero-coupon interest rate. For the purpose of mapping each cash flow, the risk manager will need to identify a set of zero-coupon bonds at different maturities. Risk-Neutral Pricing Formula for Zero-coupon bonds with Default Risk ... I am looking for the equations or papers showing the risk-neutral pricing for zero-coupon bonds including default risk. I already tried Googling and searching SSRN and Jstor. bond zero-coupon risk-neutral. Share. Improve this question. Follow asked Apr 4, 2020 at 17:02. Jake Freeman Jake Freeman. 158 4 4 ... Zero-coupon bonds are free from re-investment risks In the case of zero-coupon bonds,since there are no intermediate cash flows,there is no such risk. Another important characteristic of such securities is that their duration is equal to their time to maturity. Duration,in the case of plain-vanilla bonds,may be perceived as the effective maturity or the weighted average maturity of the cash flows. Understanding Zero Coupon Bonds - Part One - The Balance Risk of Default Corporate zero coupon bonds carry the most risk of default and pay the highest yields. Many of these have call provisions. How big of a discount will you pay? Here is an example of how zero coupon bond prices can change: For example, assume that three STRIPS are quoted in the market at a yield of 6.50%.

Pros and Cons of Zero-Coupon Bonds | Kiplinger With retirement years away for you and today's low interest rates, we'd advise against buying zeros. These bonds don't make regular interest payments. Instead, they're sold at a big discount to ... Pulled-to-Par Returns for Zero-Coupon Bonds Historical Simulation Value ... Due to bond prices pull-to-par, zero-coupon bond historical returns are not stationary, as they tend to zero as time to maturity approaches. Given that the historical simulation method for computing value at risk (VaR) requires a stationary sequence of historical returns, zero-coupon bonds' historical returns cannot be used to compute VaR by historical simulation. Their use would ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Zero Coupon Muni Bonds - What You Need to Know The largest benefit of zero coupon muni bonds is the low minimum investment since the securities are sold at a discount to face value. For example, a bond with a face value of $10,000 that matures in 20 years with a 5.5% coupon may be purchased for less than $5,000. This means that investors can purchase more face value at a lower upfront ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As a result, zero-coupon bond prices are more volatile — subject to greater swings when interest rates change. You have to pay taxes on income you don't get Even though you're not actually getting...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Pros of Zero-Coupon Bonds. There are many zero-coupon bonds that are already in existence. Also, each year, many new zero-coupon bonds are issued. Despite there being so many zero-coupon bonds, the issues get sold out relatively easily. These bonds are so popular because they have certain advantages. Some of the advantages of these bonds have been mentioned below: Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and ...

Zero-Coupon Bond - an overview | ScienceDirect Topics Zero-coupon bonds linked to the inflation do not pay coupons. Therefore, the unique adjustment is made to the principal. These types of bonds offer no reinvestment risk due to the absence of coupon payments and have the longest duration than other inflation-linked bonds. The value is given by Equation (6.8): (6.8)

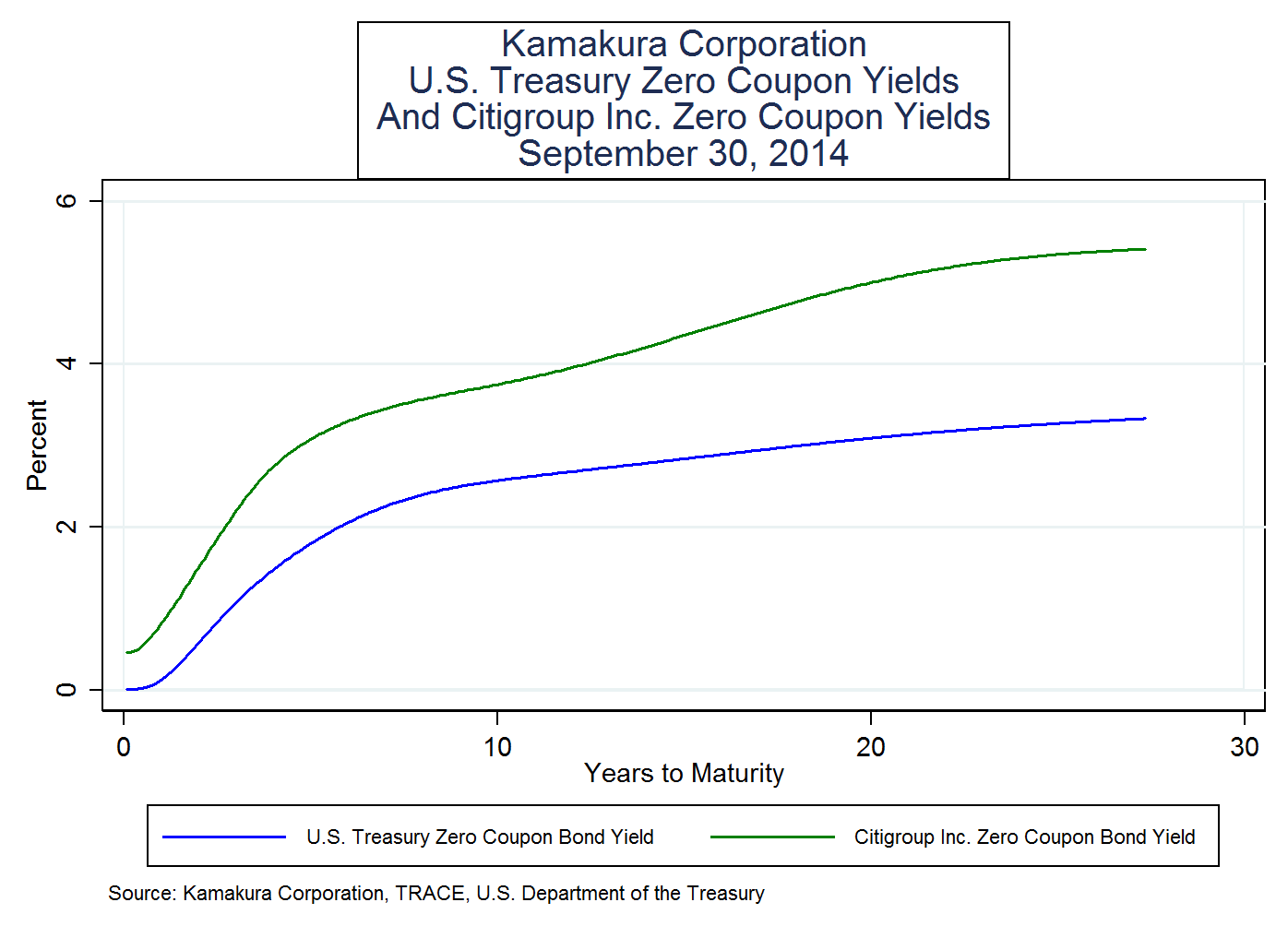

Advantages and Risks of Zero Coupon Treasury Bonds Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly...

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations. Therefore, in case of longer time duration (a higher 'N'), it might prove to be profitable for the bond holder. Disadvantages of Zero-Coupon Bonds

Computing Risk Free Rates and Excess Returns Part 1: From ... - Refinitiv This article explains what Net Present Values, Face Values, Maturities, Coupons, Yield to Maturity, compound frequency, Coupon rates and risk-free rates are, how to compute them, and how they are used to calculate excess returns using only Zero-Coupon Bonds; other types of bonds are discussed for completeness, but they will only be investigated as such in further articles to come.

Zero-Coupon Bond Definition - Investopedia Zero-coupon bonds are like other bonds, in that they do carry various types of risk, because they are subject to interest rate risk if investors sell them before maturity. How Does a Zero-Coupon...

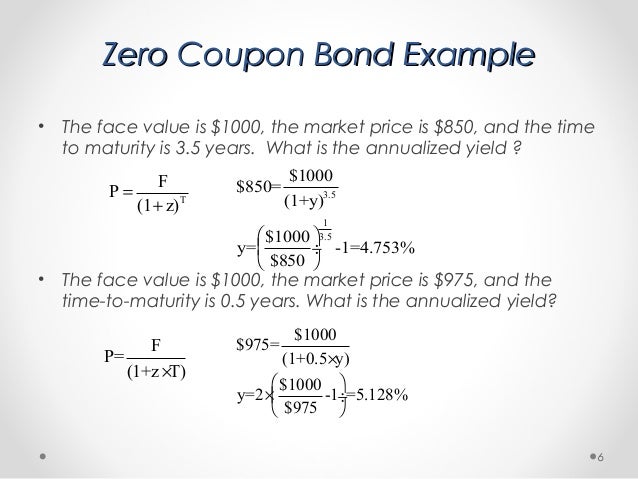

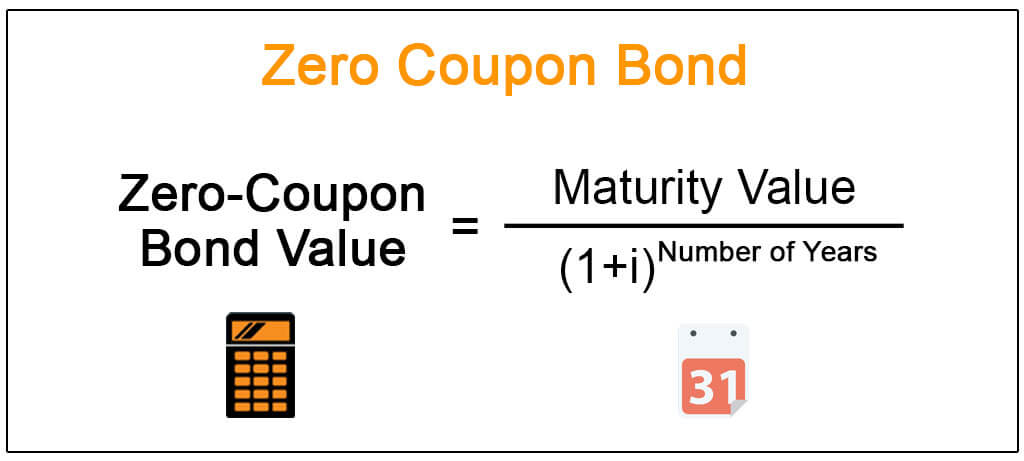

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero-coupon bonds news and analysis articles - Risk.net You are currently accessing Risk.net via your Enterprise account. If you already have an account please use the link below to sign in. If you have any problems with your access or would like to request an individual access account please contact our customer service team. Phone: 1+44 (0)870 240 8859. Email:

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "43 zero coupon bonds risk"