42 are zero coupon bonds taxable

recorder.butlercountyohio.org › search_records › subdivisionWelcome to Butler County Recorders Office Copy and paste this code into your website. Your Link Name › terms › sSeries I Bond Definition - Investopedia Jun 03, 2022 · Series I Bond: A non-marketable, interest-bearing U.S. government savings bond that earns a combined: 1) fixed interest rate; and 2) variable inflation rate (adjusted semiannually). Series I bonds ...

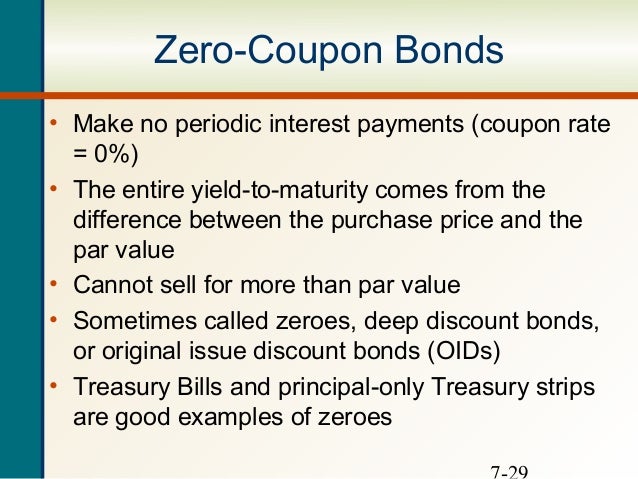

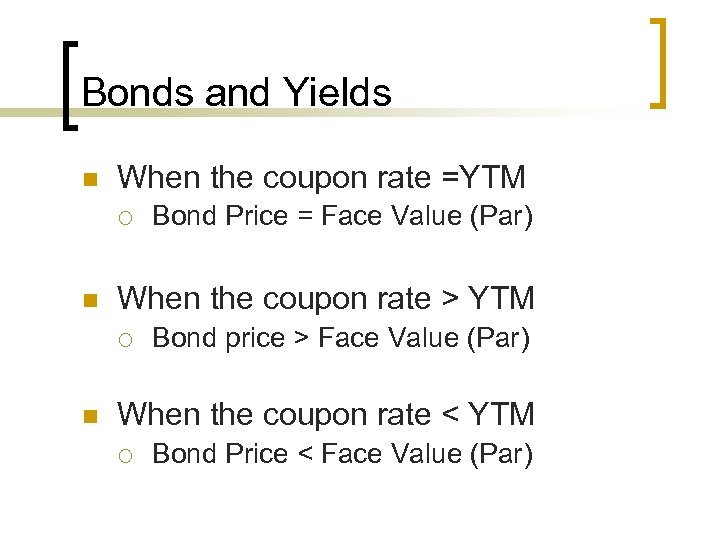

› productpage › bondsInvesting in Bonds Online in India | HDFC Securities Aug 08, 2022 · Learn about investing in bonds and generating a predictable source of income with different types of bonds. Types of Bond ZERO-COUPON BONDS These investment bonds are issued at a discount, but redeemed at the principal amount.

Are zero coupon bonds taxable

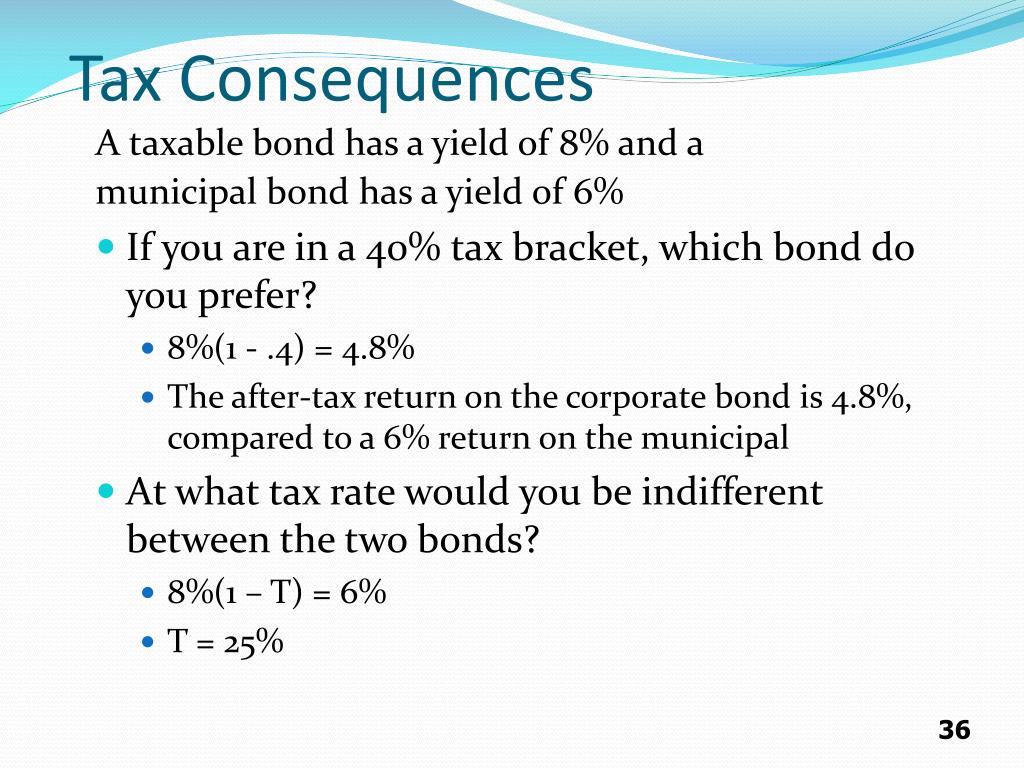

achieverpapers.comAchiever Papers - We help students improve their academic ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... › how-bonds-are-taxedAre Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing ... May 01, 2022 · Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ...

Are zero coupon bonds taxable. economictimes.indiatimes.com › definitionWhat is 'Affiliate Marketing' - The Economic Times Beta is a numeric value that measures the fluctuations of a stock to changes in the overall stock market. Description: Beta measures the responsiveness of a stock's price to changes in the overall stock market. On comparison of the benchmark index for e.g. NSE Nifty to a particular stock returns, a pattern develops that shows the stock's ... › how-bonds-are-taxedAre Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing ... May 01, 2022 · Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ... › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... achieverpapers.comAchiever Papers - We help students improve their academic ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment.

Post a Comment for "42 are zero coupon bonds taxable"