45 ytm zero coupon bond

Current yield - Wikipedia When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. For zero-coupon bonds selling at a discount, the coupon yield and current yield are zero, and the YTM is positive. See also. Adjusted current yield; References. Current Yield at … Microsoft Excel Bond Yield Calculations | TVMCalcs.com We know that the bond carries a coupon rate of 8% per year, and the bond is selling for less than its face value. Therefore, we know that the YTM must be greater than 8% per year. You need to remember that the bond pays interest semiannually, and we entered Nper as the number of semiannual periods (6) and Pmt as the semiannual payment amount ...

Current Yield vs. Yield to Maturity - Investopedia 13.12.2021 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon ...

Ytm zero coupon bond

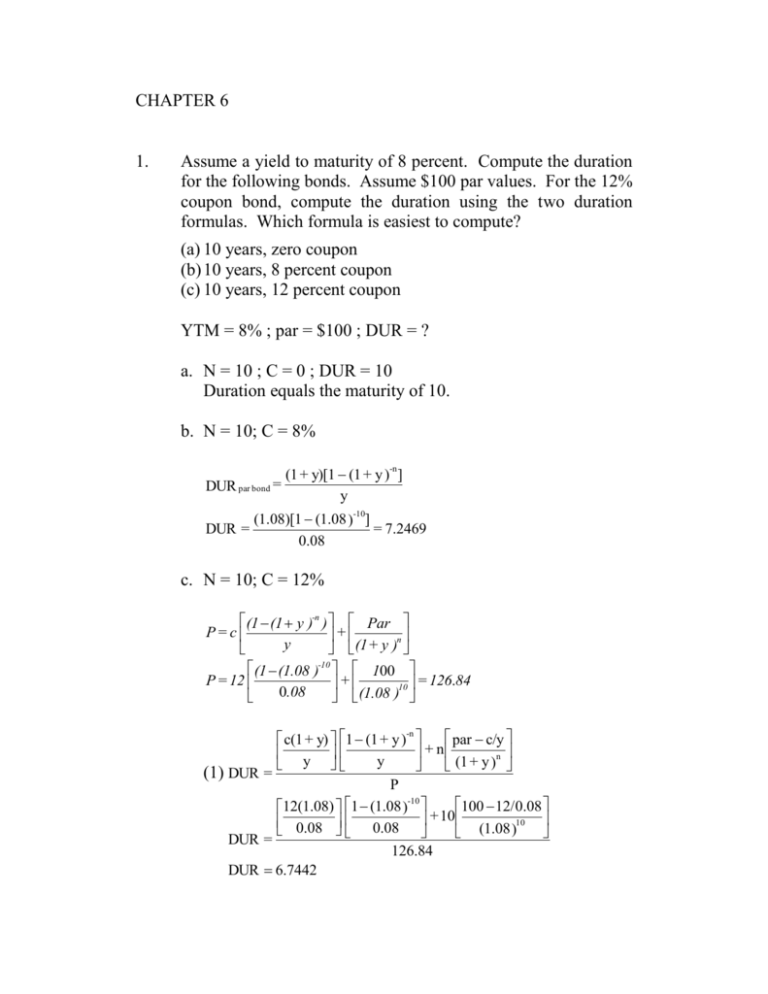

Bond Yield to Maturity (YTM) Calculator - DQYDJ You can compare YTM between various debt issues to see which ones would perform best. Note the caveat that YTM though – these calculations assume no missed or delayed payments and reinvesting at the same rate upon coupon payments. For other calculators in our financial basics series, please see: Zero Coupon Bond Calculator Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. The prevailing ...

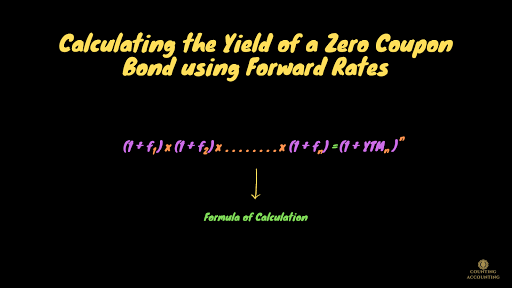

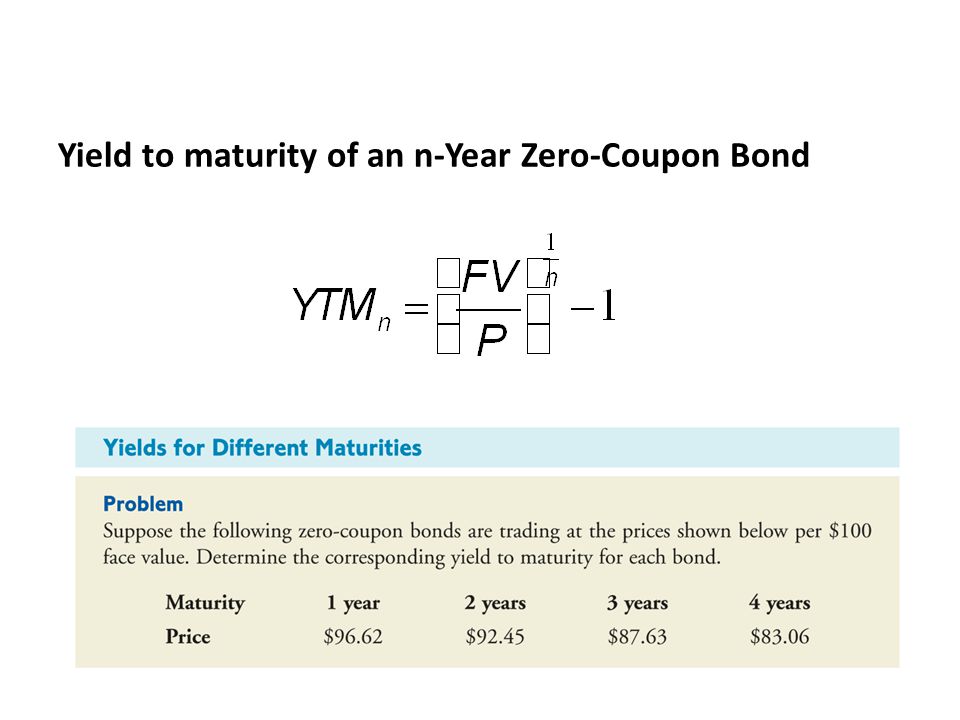

Ytm zero coupon bond. Yield to Maturity (YTM) - Investopedia 31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical bonds a great source of … Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Bonds - Overview, Examples of Government and Corporate Bonds 04.02.2022 · 5. Zero-coupon bond. Zero-coupon bonds make no coupon payments but are issued at a discounted price. 6. Municipal bonds. Bonds issued by local governments or states are called municipal bonds. They come with a greater risk than federal government bonds but offer a higher yield. Examples of Government Bonds. 1. The Canadian government issues a 5 ...

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. The prevailing ... Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Bond Yield to Maturity (YTM) Calculator - DQYDJ You can compare YTM between various debt issues to see which ones would perform best. Note the caveat that YTM though – these calculations assume no missed or delayed payments and reinvesting at the same rate upon coupon payments. For other calculators in our financial basics series, please see: Zero Coupon Bond Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/19095826/Yield-to-Maturity-YTM-Formula.jpg)

Post a Comment for "45 ytm zero coupon bond"