42 value of zero coupon bond

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond ... Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep A Zero-Coupon Bond is priced at a discount to the face (par) value with no periodic interest payments from the issuance date until maturity.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no ...

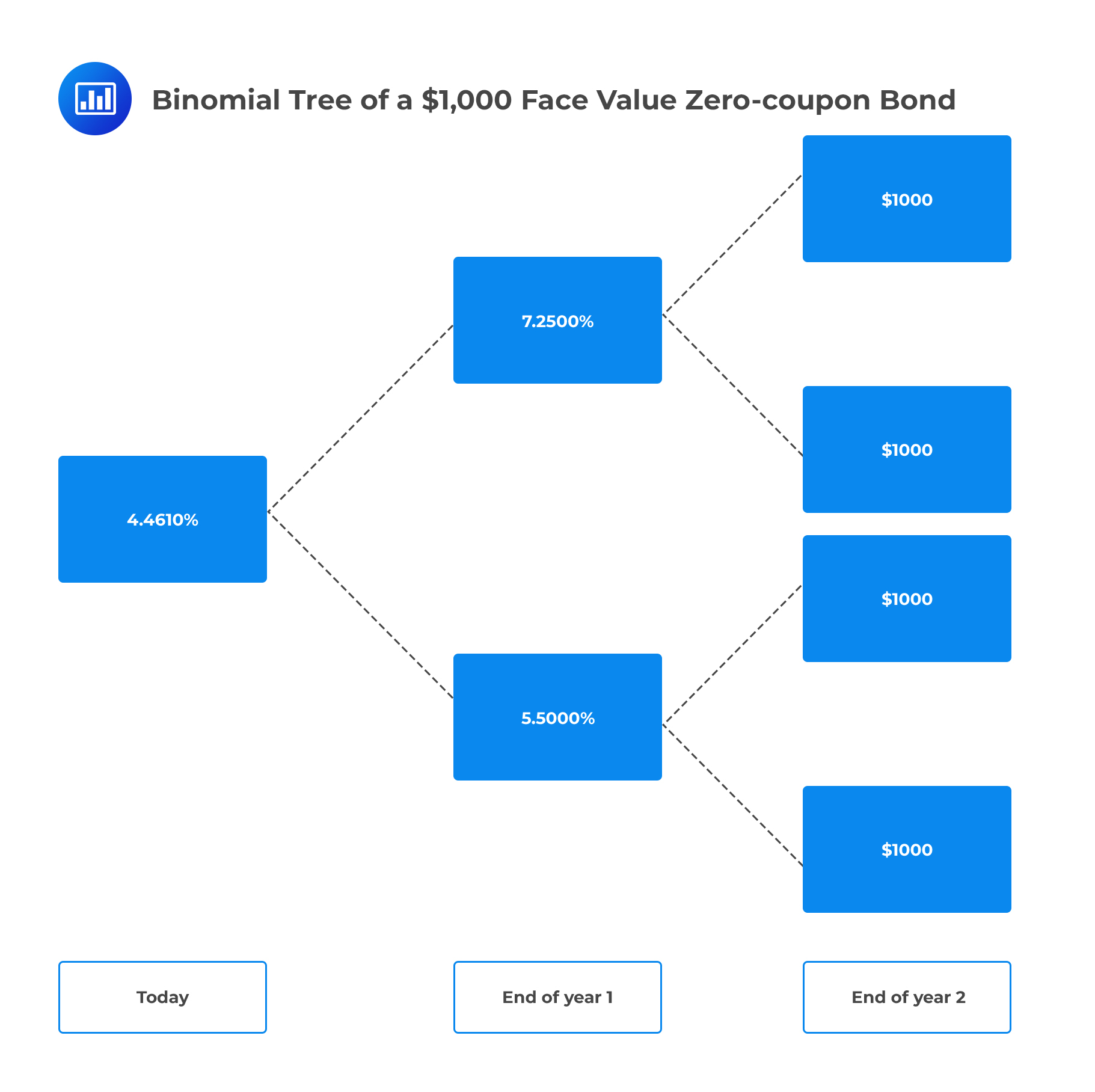

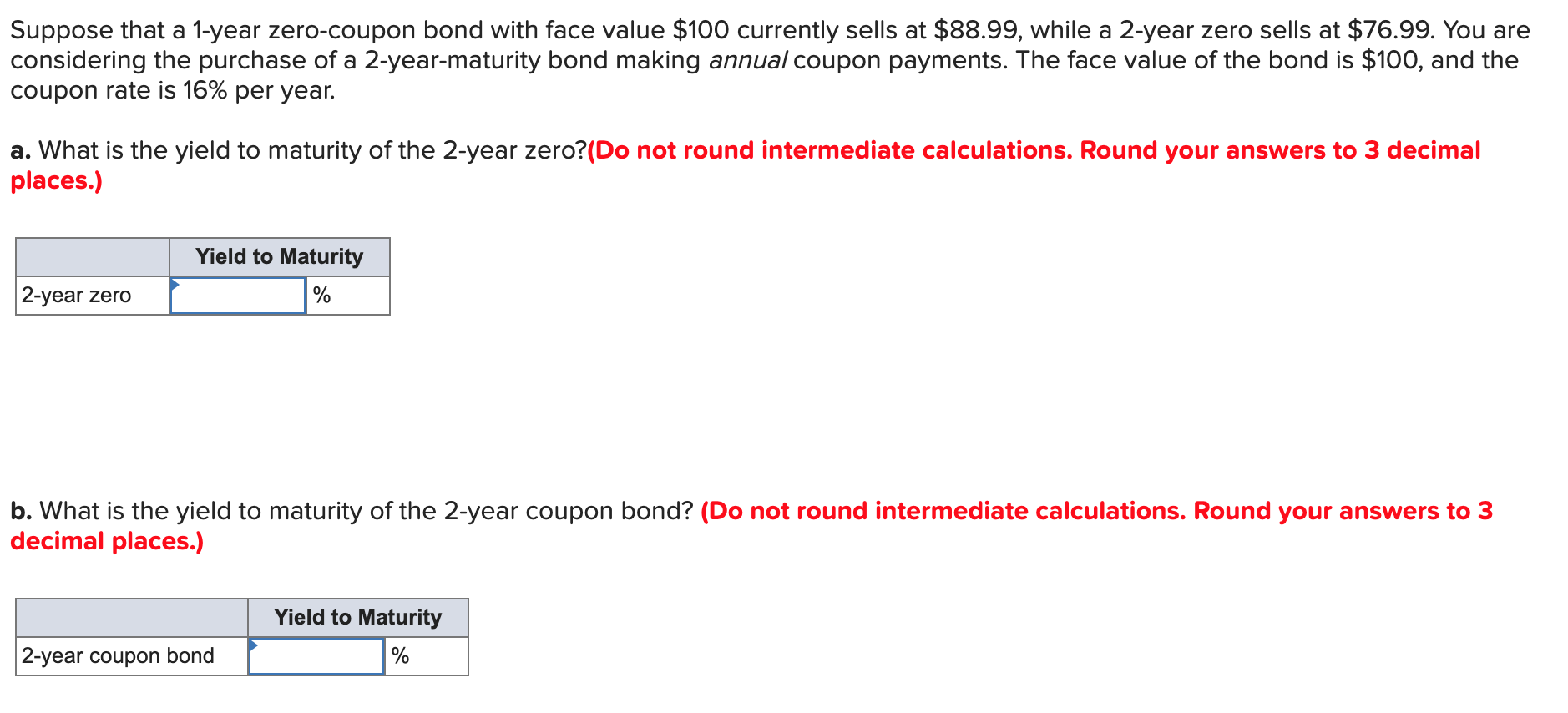

Value of zero coupon bond

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator Mar 24, 2021 ... Face Value is equivalent to the bond's future or maturity value. The formula above applies when zero-coupon bonds are compounded annually. When ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. · Zero-coupon bonds trade at deep discounts, offering full face value (par) profits ... Calculate Zero-coupon Bond Purchase Price Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power ...

Value of zero coupon bond. Zero Coupon Bond Value - Financial Formulas (with Calculators) A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one ... Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 ... A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or ... Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... Unlike the regular, coupon-paying bonds, a zero-coupon bond has an imputed interest rate (rather than an established interest rate). To ... Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value ...

Calculate Zero-coupon Bond Purchase Price Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. · Zero-coupon bonds trade at deep discounts, offering full face value (par) profits ... Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator Mar 24, 2021 ... Face Value is equivalent to the bond's future or maturity value. The formula above applies when zero-coupon bonds are compounded annually. When ...

![Solved Problem 1 [2pts] Suppose the prices of zero-coupon ...](https://media.cheggcdn.com/media/d09/d093474f-60fc-4291-942a-83c299f0ed41/phpKFnTMF)

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 value of zero coupon bond"