42 are treasury bills zero coupon bonds

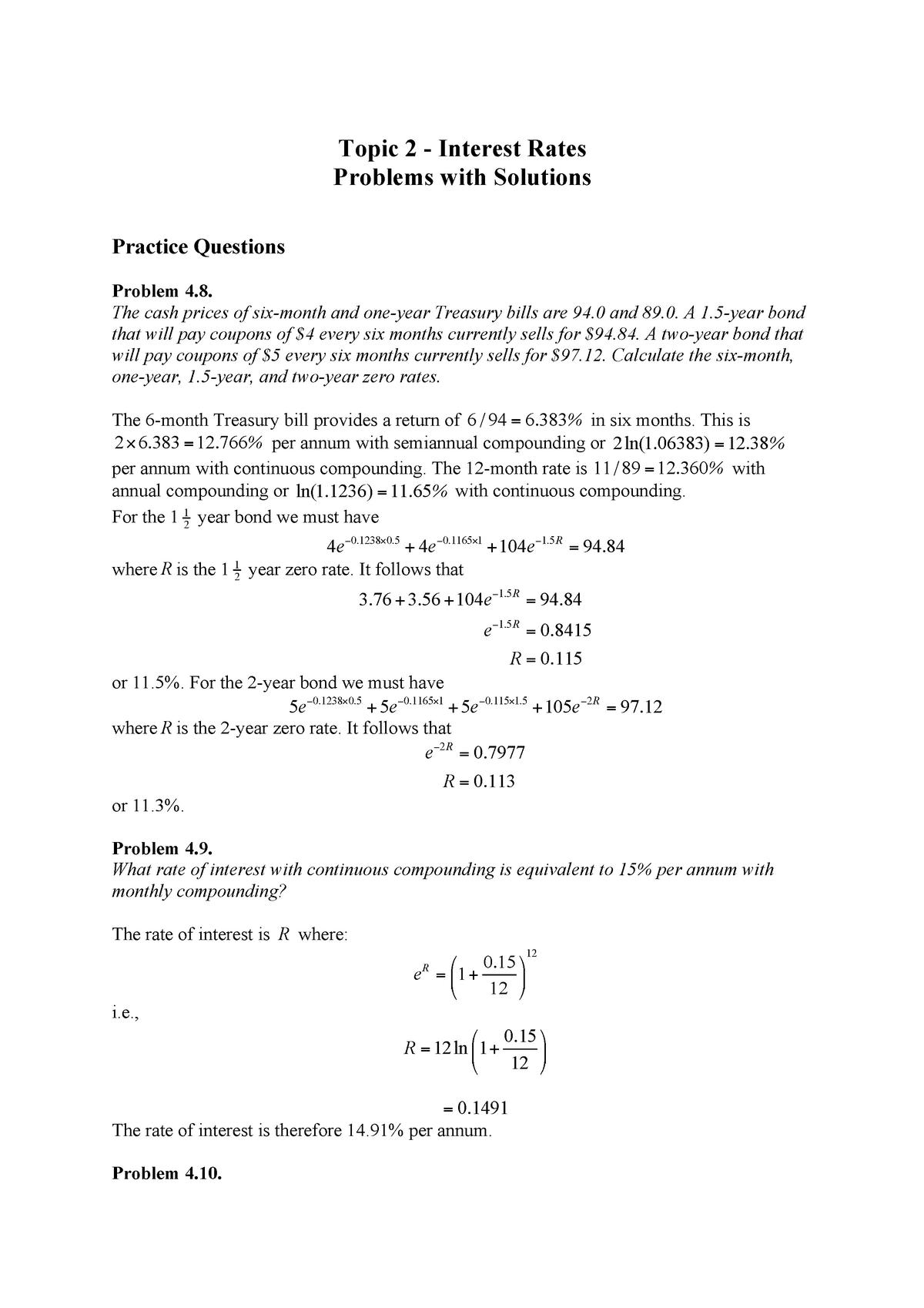

› treasury-bondsHow To Buy Treasury Bonds And Buying Strategies To Consider Sep 28, 2022 · Step 2: You will see a chart that shows all types of bonds based on duration. I’ve highlighted the U.S. Treasury row in a red box. In the image, the U.S. Treasury yields range from 4.15% for a 3-month treasury bill (was 3.5% in September 2022) to 4.15% on a 30-year Treasury bond. Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo Treasury bills are a type of zero-coupon security where the central government borrows funds from the individual for a period of 364 days or less. In return, the investors receive interest. These money market instruments provide a return on investment at once, and there is no provision for periodic returns.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate 3. The compounding of this interest raises the principal by $1,068 from $17,800 to $18,868. The balances to be reported in the financial statements at the end of Year One are as follows: Year One—Interest Expense (Income Statement) $1,068.

Are treasury bills zero coupon bonds

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. What are coupons in treasury bills/bonds? - Quora Treasury bills have no coupons. They are "discount" instruments, issued (sold) at a price lower than their redemption (maturity) value. The return to the investor is the difference between the maturity value and the issue price. Warner Athey Lives in Virginia Beach, VA Author has 6.1K answers and 4.5M answer views 2 y Treasury Bills - Guide to Understanding How T-Bills Work Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up to 52 weeks. ... They have a maturity period of between 20 years and 30 years, with coupon payments every six months. T-bond offerings were suspended for four years between February 2002 and February ...

Are treasury bills zero coupon bonds. Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Bonds pay interest in the form of a coupon to the investors quarterly or semi-annually. T-bills do not pay any coupon. They are floated as a zero-coupon bond to the investors, issued at discounts, and the investors receive the face value at the end of the tenure, which is the return on their investment. T-bills have no default risk › ask › answersTreasury Bonds vs. Treasury Notes vs. Treasury Bills: What's ... Mar 29, 2022 · Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ... How To Invest In Treasury Bills - Forbes Advisor Instead, they're called "zero-coupon bonds," meaning that they're sold at a discount and the difference between the purchase price and the par value at redemption represents the accrued... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

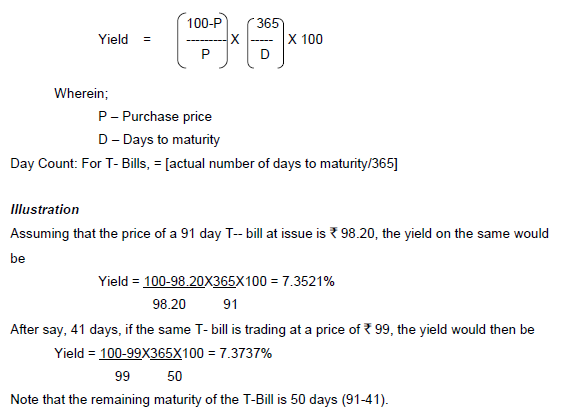

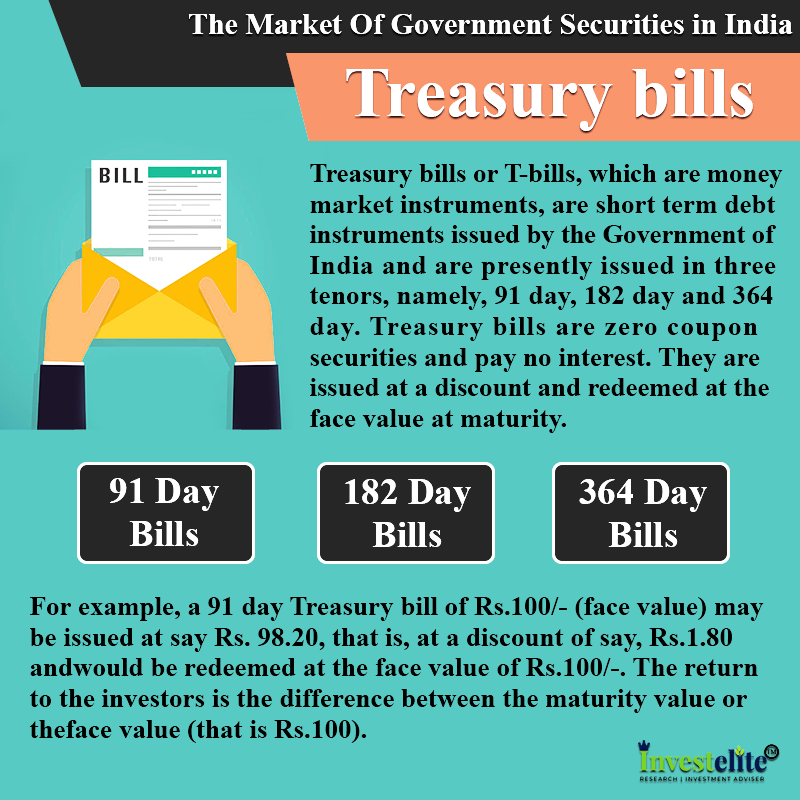

Treasury Announces Guidance on Inflation Reduction Act's Strong Labor ... Guidance starts 60-day "clock" for key labor provisions to take effect WASHINGTON - Today, the Treasury Department announced initial guidance on the Inflation Reduction Act's strong labor standards that firms must meet to qualify for enhanced clean energy and climate tax incentives. The guidance, which can be read in full here and will be published in the Federal Register tomorrow, is an ... What's the difference between a zero-coupon bond and a Treasury bill ... T-bills do not pay any coupon. They are floated as a zero-coupon bond to the investors, they are issued at discounts, and the investors receive the face value at the end of the tenure, which is the return on their investment. Bonds pay interest in the form of a coupon to the investors quarterly or semi-annually. Vijay Krishnan 2 y Promoted Treasury Bonds — TreasuryDirect Treasury Bonds We sell Treasury Bonds for a term of either 20 or 30 years. Bonds pay a fixed rate of interest every six months until they mature. You can hold a bond until it matures or sell it before it matures. Treasury Bonds are not the same as U.S. savings bonds EE Bonds, I Bonds, and HH Bonds are U.S. savings bonds. What is Treasury Bill (T-bill)? - Indian Economy Treasury bills are zero coupon securities and pay no interest. Rather, they are issued at a discount (at a reduced amount) and redeemed (given back money) at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the ...

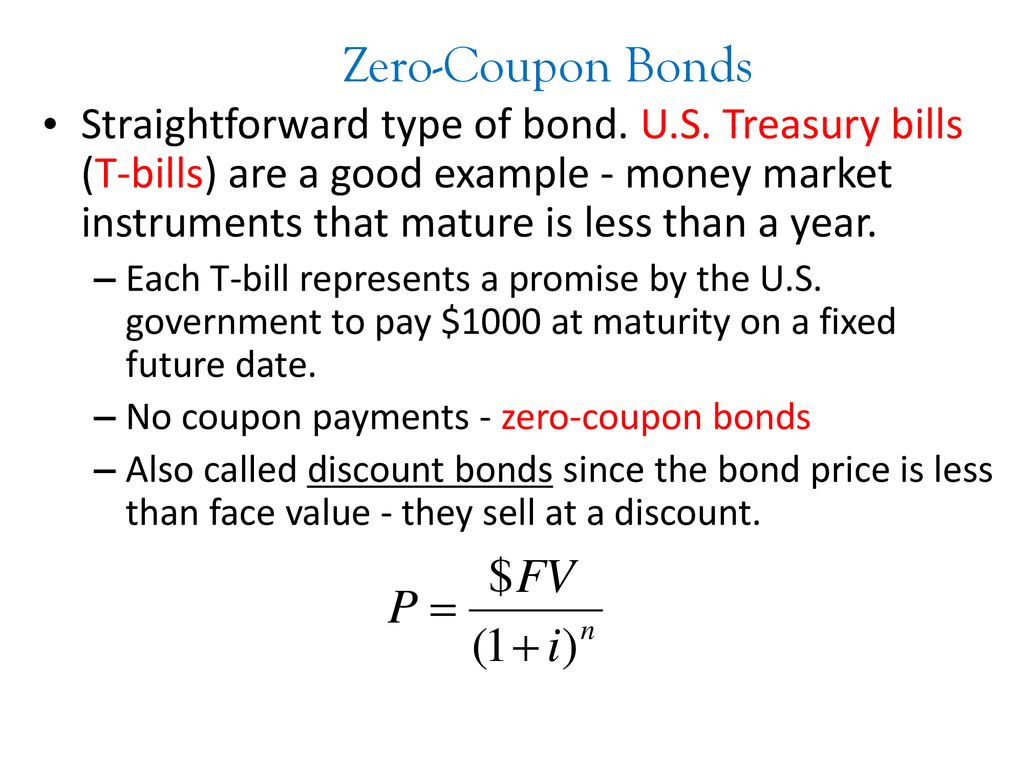

Treasury Bills — TreasuryDirect Treasury Marketable Securities Treasury Bills Treasury Bills We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). When the bill matures, you are paid its face value. You can hold a bill until it matures or sell it before it matures. en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills. The US Treasury bill market is the most active and liquid debt market in the world. are also called zero coupon bonds. - BYJU'S are also called zero coupon bonds. The correct option is C. Treasury bills (c) Treasury bills. Explanation: Treasury bills are money market instruments provided by the Government of India as a promissory note with ensured reimbursement on a specific date in the future. Assets gathered through such tools are ordinarily used to meet momentary necessities or for short-term use requirements of the ... Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

› bills-bonds › treasury-bondsTreasury Bonds | CBK Oct 24, 2022 · five year and fifteen year fixed coupon treasury bonds issue nos. fxd 1/2013/5 & fxd 2/2013/15: 25/03/2013: two year and re-opening of ten year fixed coupon treasury bonds issue nos. fxd 2/2013/2 & fxd 1/2012/10: 25/02/2013: two and fifteen year fixed coupon treasury bonds issue nos. fxd 1/2013/2 & fxd 1/2013/15: 09/01/2013

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

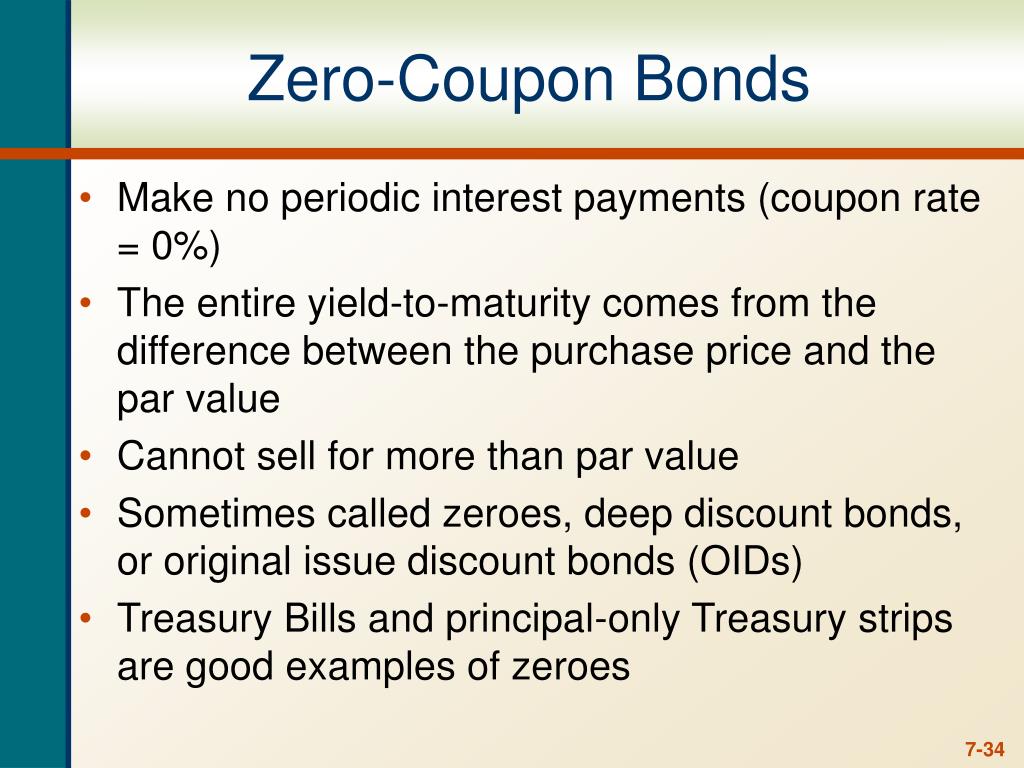

Zero-Coupon Bond - Definition, How It Works, Formula It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds.

Treasury Coupon Bonds - Economy Watch Rather, the bonds are sold at prices lower than face value and their redemption is on par with the face value. Some fixed income securities such as US Savings bonds and US Treasury Bills are zero coupon bonds. You can buy certain treasury coupon bonds that are transferable just like bearer bonds.

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

newbie question on treasury bills : r/bonds I'm buying Treasury bills on Fidelity but I'm so confused over the coupon rate vs the yield. I remember from a class that the coupon rate is the interest income the bond buyer gets. ... Tbills have a maturity of < 1 year and are zero coupon bonds. Meaning they don't pay you a coupon twice per year like other treasuries that have a maturity of ...

Treasury Bills - Types, Features and Advantages of Government ... - Groww Treasury bills are zero-coupon securities, issued at a discount to investors. Hence, total returns generated by such instruments remain constant through the tenure of bond, irrespective of economic conditions and business cycle fluctuations.

Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Some of the key bonds are Municipal bonds, Governments bonds, corporate bonds, Zero Coupons bonds, etc. Bonds also called fixed-income instruments. Example: Let's say Smith purchased a government bond from the government for a worth of INR 10,000 and the term of the bond is 10 years, with an interest rate of 4.75%.

en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different number of months.

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

How To Invest In Treasury Bonds & Bills In Kenya | Complete Guide Zero coupon bonds are similar to Treasury bills, in that they are sold at a discount and do not have interest payments. They are also typically issued for a short period of time. When you are ready to invest, you should begin monitoring the upcoming bond prospectuses available on the CBK website, to find the right opportunity for you.

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Treasury Bills - Guide to Understanding How T-Bills Work Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up to 52 weeks. ... They have a maturity period of between 20 years and 30 years, with coupon payments every six months. T-bond offerings were suspended for four years between February 2002 and February ...

What are coupons in treasury bills/bonds? - Quora Treasury bills have no coupons. They are "discount" instruments, issued (sold) at a price lower than their redemption (maturity) value. The return to the investor is the difference between the maturity value and the issue price. Warner Athey Lives in Virginia Beach, VA Author has 6.1K answers and 4.5M answer views 2 y

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Post a Comment for "42 are treasury bills zero coupon bonds"