40 the coupon rate of a bond is equal to

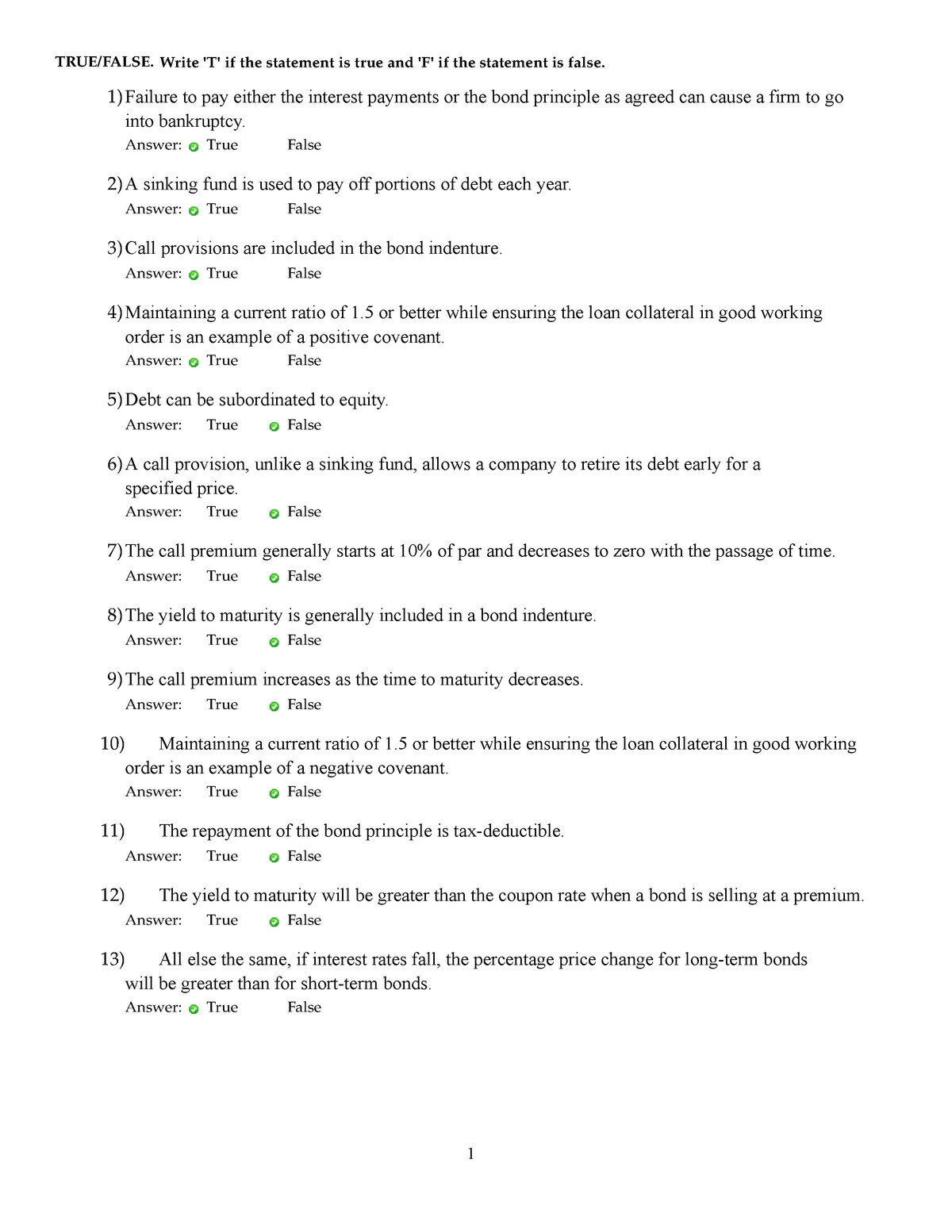

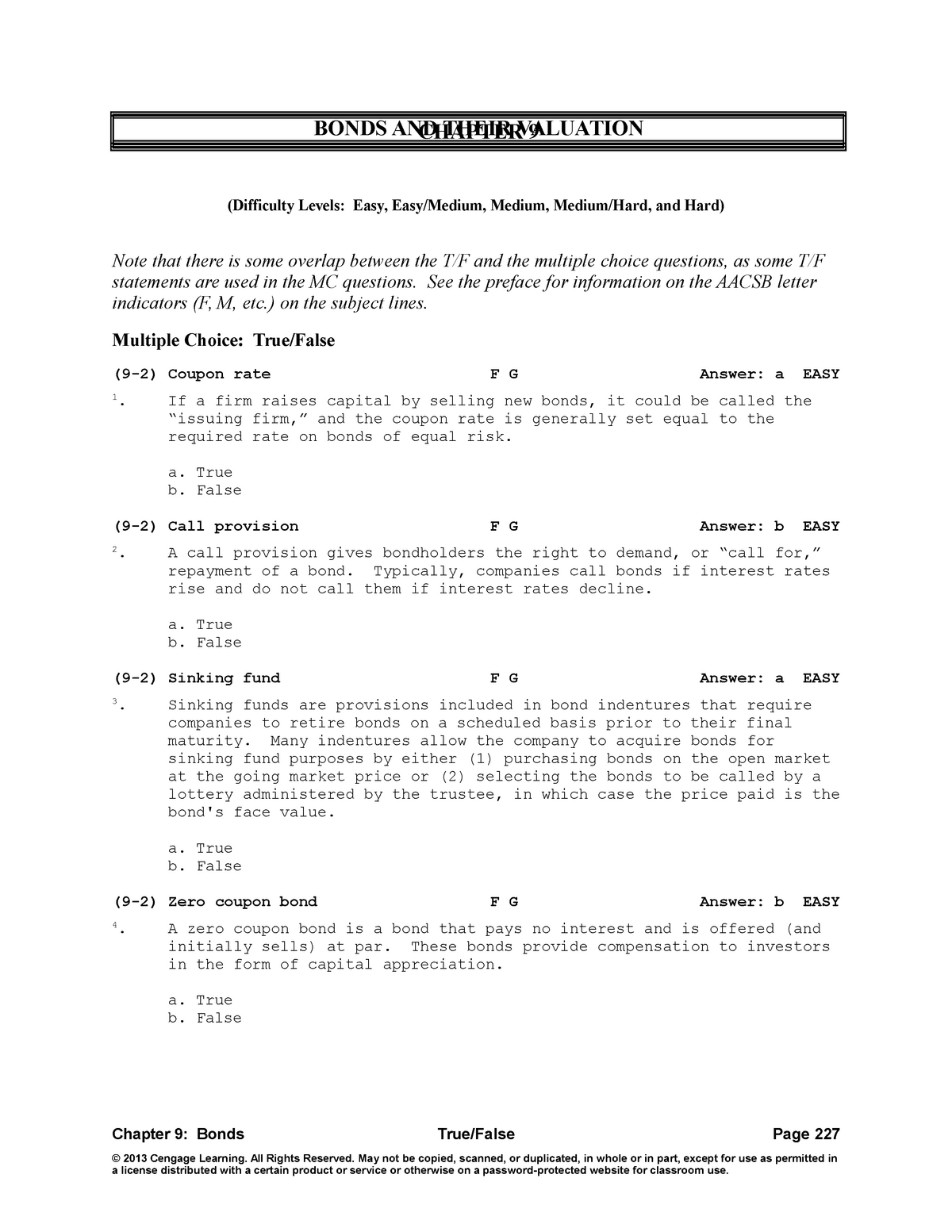

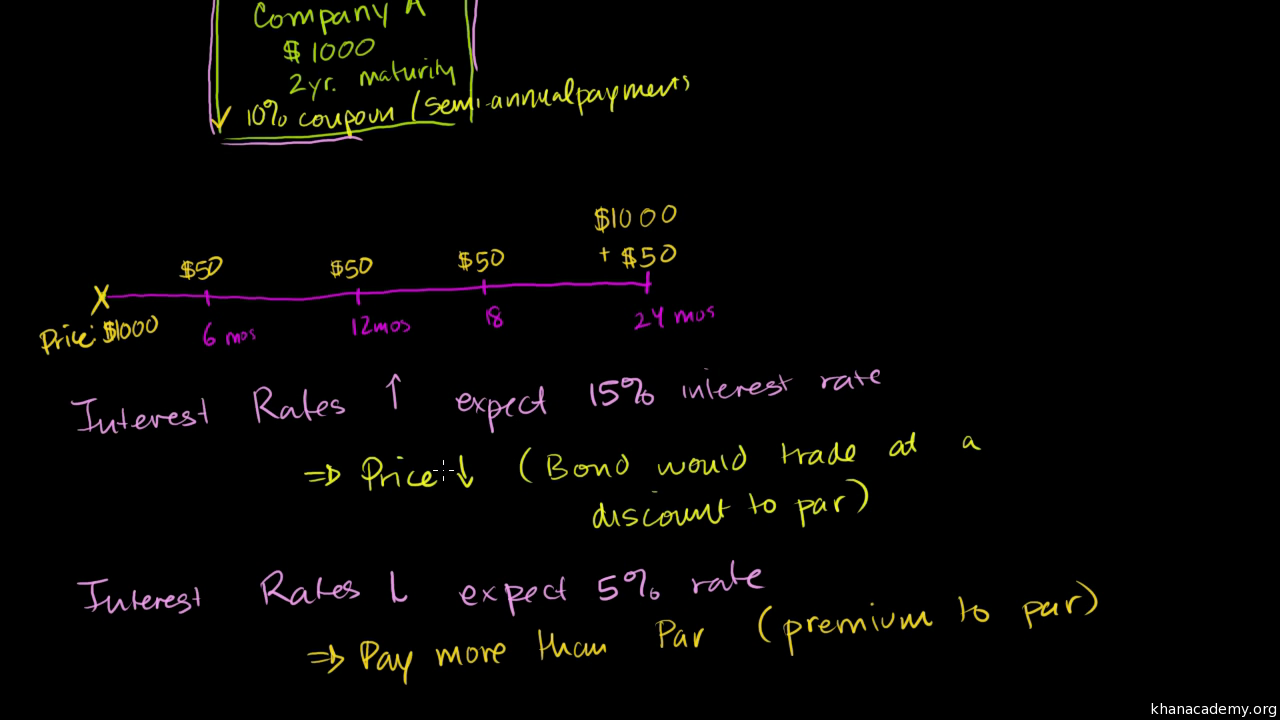

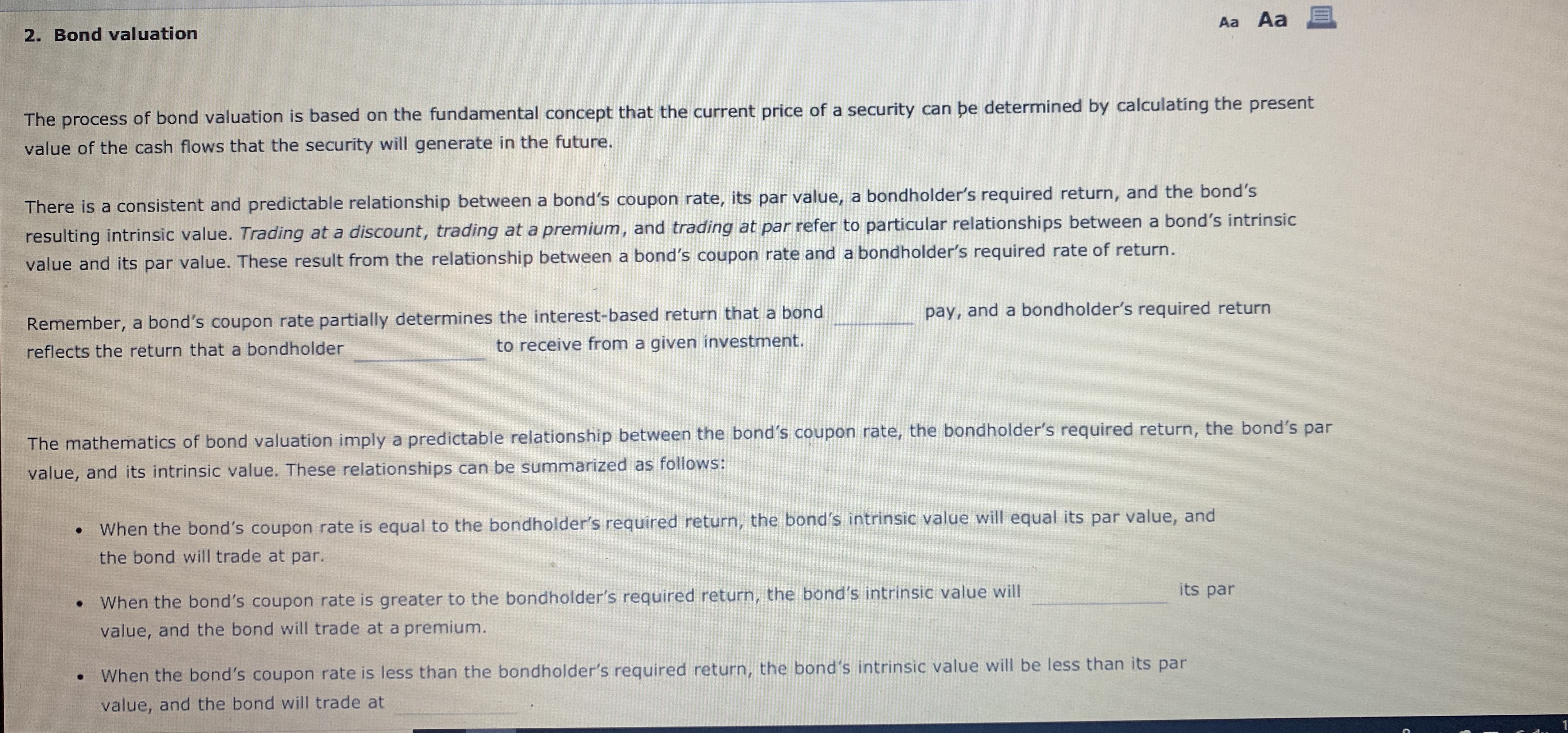

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Zero-Coupon Bonds. A zero-coupon bond is a bond without coupons, and its coupon rate is 0%. The issuer only pays an amount equal to the face value of the bond at the maturity date. Instead of paying interest, the issuer sells the bond at a price less than the face value at any time before the maturity date. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Coupon Rate Definition For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable for ...

The coupon rate of a bond is equal to

Buying a $1,000 Bond With a Coupon of 10% - Investopedia If the bond is selling at a face value of $1,000, or par, the coupon payment is equal to the yield, which in this case is 10%.This would also imply that prevailing interest rates are also right ... How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. 1. The ...

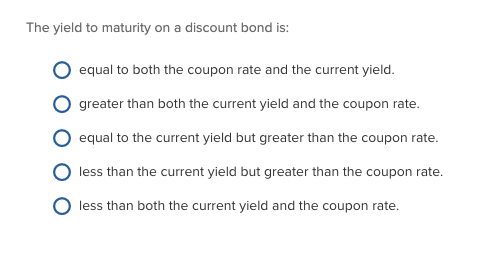

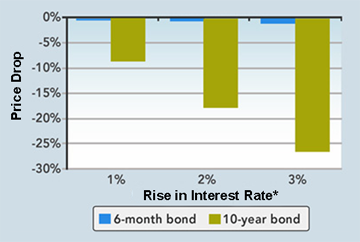

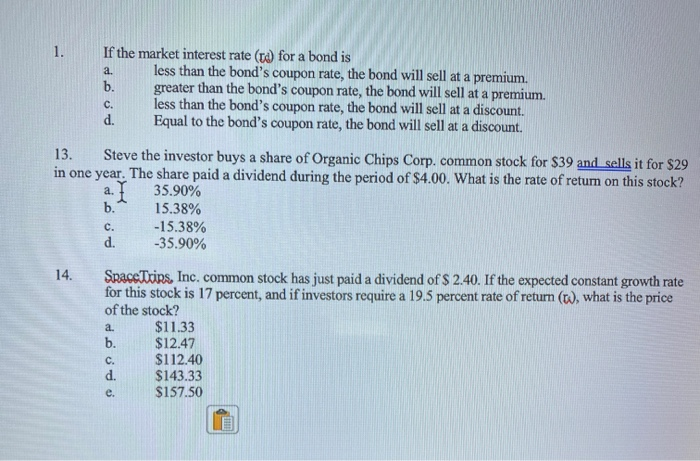

The coupon rate of a bond is equal to. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Finance Chapter 6 (Practice Questions) Flashcards | Quizlet The difference between the bid price and the asked price of a bond is the _______. less than face value. When the interest rate is higher than a bond's coupon rate, the bond will be priced at: B. A change in interest rate has the greatest effect on the present value of: A. short-term cash flows. B. distant cash flows. Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Coupon Rate Calculator | Bond Coupon Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate ...

1. the Coupon Rate of a Bond Equals - Docest A) The coupon rate increases to 10%. B) The coupon rate remains at 9%. C) The coupon rate remains at 8%. D) The coupon rate decreases to 8%. Answer: C. 10. When the yield curve is upward-sloping, then: A) short-maturity bonds offer high coupon rates. B) long-maturity bonds are priced above par value. Coupon Bond - Guide, Examples, How Coupon Bonds Work Nevertheless, the term "coupon" is still used, but it merely refers to the bond's nominal yield. How Does a Coupon Bond Work? Upon the issuance of the bond, a coupon rate on the bond's face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These ... Solved If the coupon rate of a bond is equal to its required - Chegg This problem has been solved! See the answer. If the coupon rate of a bond is equal to its required rate of return, then ________. Select one: a. the current value is not equal to par value. b. the current value is equal to par value. c. the maturity value is equal to par value. d. the current value is equal to maturity value. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ... Bond Discount - Investopedia Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ... When is a bond's coupon rate and yield to maturity the same? - Investopedia The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. A bond's coupon rate is equal to the annual interest divided ... - OneClass Which one of the following bonds is the most sensitive to changes in market interest rates? A. Zero-coupon, 25 year. B. 10% annual coupon, 3 year. C. Zero-coupon, 15 year. D. 5% annual coupon, 10 year

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. 1. The ...

How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Buying a $1,000 Bond With a Coupon of 10% - Investopedia If the bond is selling at a face value of $1,000, or par, the coupon payment is equal to the yield, which in this case is 10%.This would also imply that prevailing interest rates are also right ...

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

![Bond Yield: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/11180917/Bond-Yield-Metrics-e1644621656277.jpg)

Post a Comment for "40 the coupon rate of a bond is equal to"