44 ytm for coupon bond

When the ytm coupon the bond trades at par when the When the YTM coupon the bond trades at par When the YTM coupon the bond trades from FIN 3399 at University of Texas, Dallas How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the...

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

Ytm for coupon bond

Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Bond Yield to Call (YTC) Calculator - DQYDJ Coupon Payment Frequency - How often the bond makes coupon payments. Bond YTC Calculator Outputs. Yield to Call (%): The converged upon solution for the yield to call of the current bond (the internal rate of return assuming the bond is called). Current Yield (%): The simple calculated yield which uses the current trading price and face value ... Ytm Of Coupon Bonds - bizimkonak.com Understanding Coupon Rate and Yield to Maturity of Bonds. CODES (1 days ago) Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The …

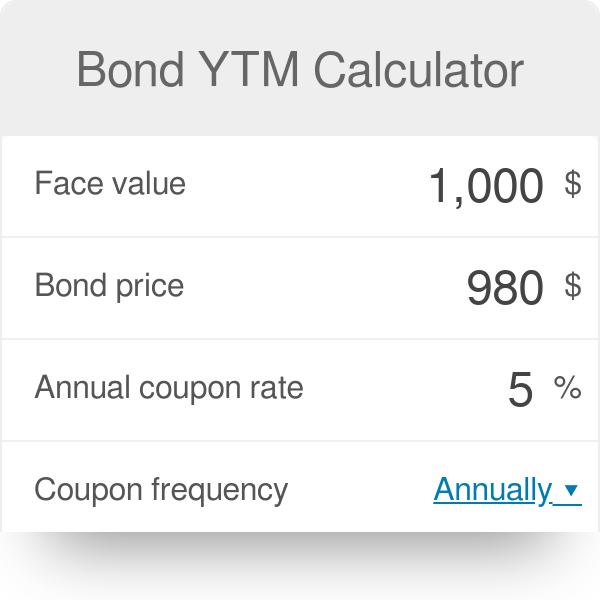

Ytm for coupon bond. Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments. YTW: Formula and Calculator (Step-by-Step) - Wall Street Prep Yield to Maturity (YTM): "= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote, 100, 1)" By contrast, the YTC switches the "maturity" to the first call date and "redemption" to the call price, which we'll assume is set at 104. Yield to Maturity vs. Yield to Call: The Difference Sep 16, 2022 · A bond's yield is the total return that the buyer will receive between the time the bond is purchased and the date the bond reaches its maturity. For example, a city might issue bonds that pay a ...

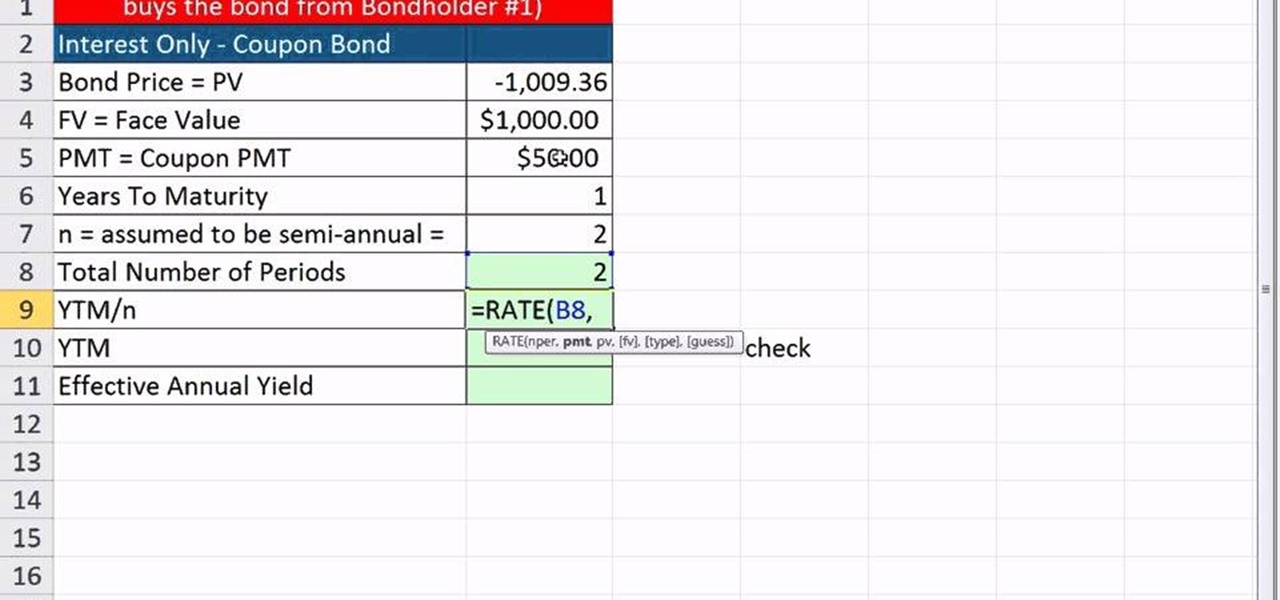

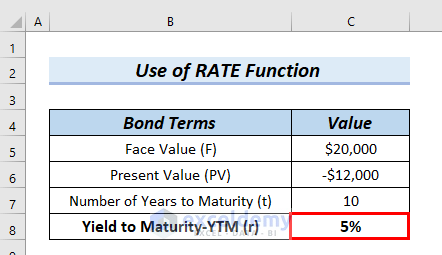

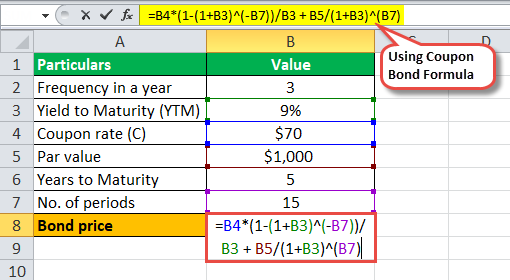

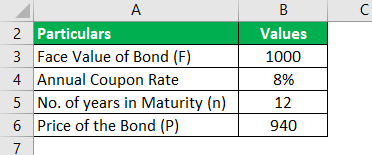

Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... How to calculate YTM in Excel | Basic Excel Tutorial Steps to follow when calculating YTM in Excel using =RATE () Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2. Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. The required yield to maturity is close to 6%. At 5.865% the price of the bond is INR 950.02. Hence, the estimated yield to maturity for this bond is 5.865%. Variations of Yield to Maturity Yield to Call Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon... Yield to Maturity (YTM): Formula and Calculator (Step-by-Step) In our hypothetical scenario, the following assumptions regarding the bond will be used to calculate the yield-to-maturity (YTM). Face Value of Bond (FV) = $1,000 Annual Coupon Rate (%) = 6.0% Number of Years to Maturity = 10 Years Price of Bond (PV) = $1,050 We'll also assume that the bond issues semi-annual coupon payments. Yield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/(1.1) 30 = 5.73). Over the coming 30 years, the price will advance to $100, and the annualized return will be 10%. What happens in the meantime? Ytm Of A Coupon Bond - bizimkonak.com Bond Yield to Maturity (YTM) Calculator - DQYDJ. CODES (2 days ago) This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. … Visit URL. Category: coupon codes Show All Coupons

The Returns on a Bond - YTM - The Fixed Income The yield to maturity of a bond might not be the same as the coupon, or interest rate paid out on the bond. ... price considers that between the current rate of 8% and the coupon of 10% there are Rs. 20 extra that will be paid as a coupon on the bond, and Rs. 13.42 less than the amount paid now that is received on maturity. ...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

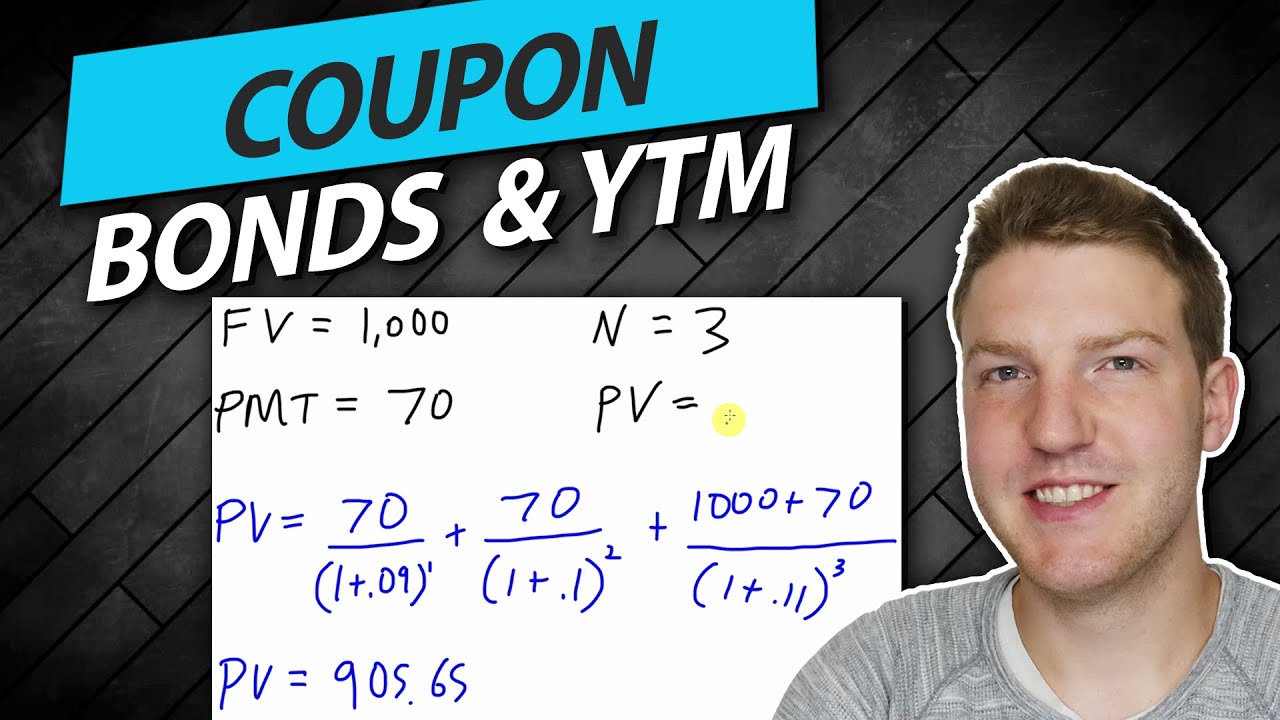

YTM of Coupon Bond | Bond Valuation Lecture 4 - YouTube This video first explains the concept of current yield and then we delve into the understanding of yield to maturity of a coupon bond. We can estimate the ytm of a coupon bond using two...

Current Yield vs. Yield to Maturity - Investopedia For example, if an investor buys a 6% coupon rate bond (with a par value of $1,000) for a discount of $900, the investor earns annual interest income of ($1,000 X 6%), or $60. The current...

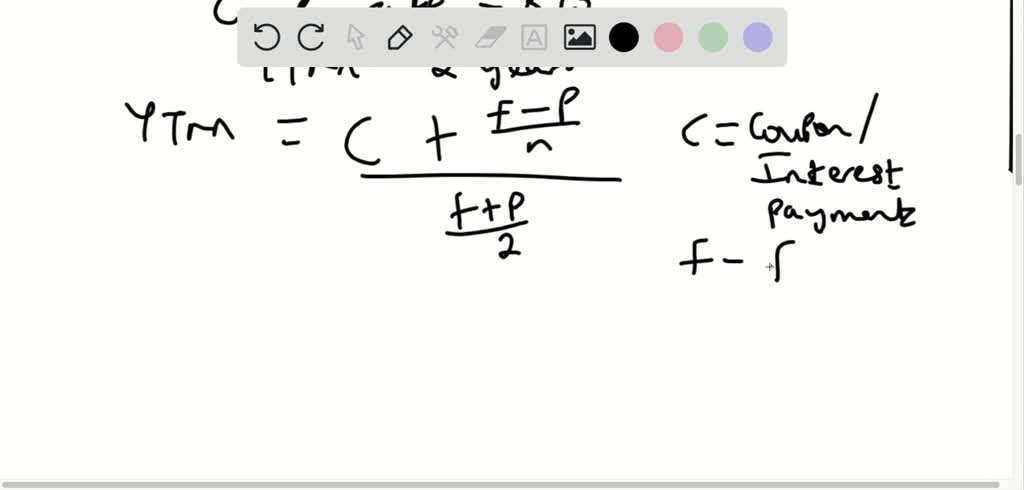

Yield to Maturity (YTM): Formula, Meaning & Calculation - ET Money Blog In the case of a Bond, YTM is defined as the total rate of return that a Bond Holder expects to earn if a Bond is held till maturity. The YTM formula for a single Bond is: Yield to Maturity = [Annual Interest + { (FV-Price)/Maturity}] / [ (FV+Price)/2] In the above formula, Annual Interest = Annual Interest Payout by the Bond.

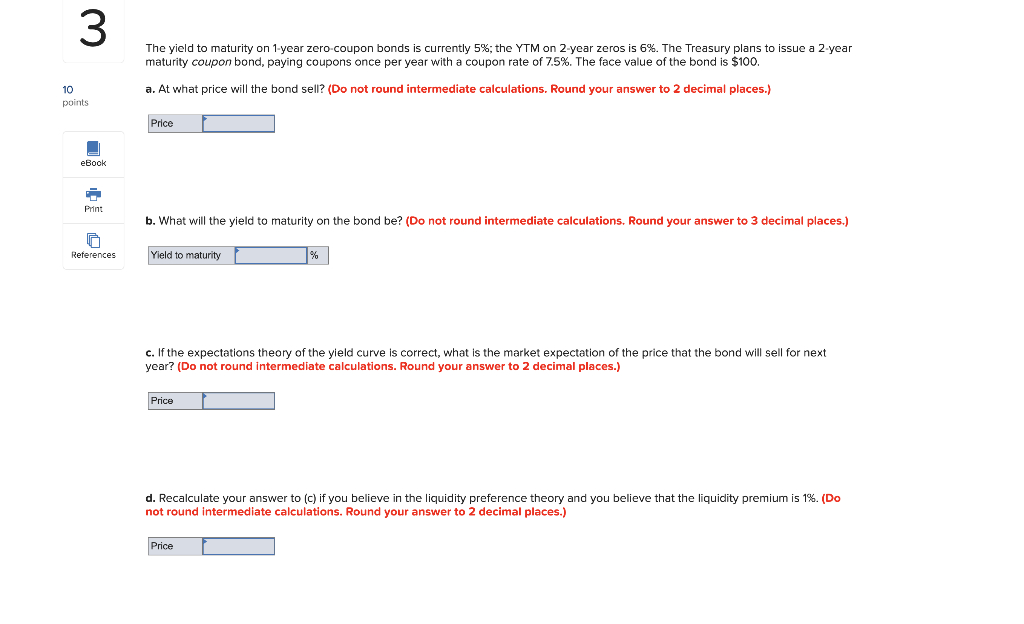

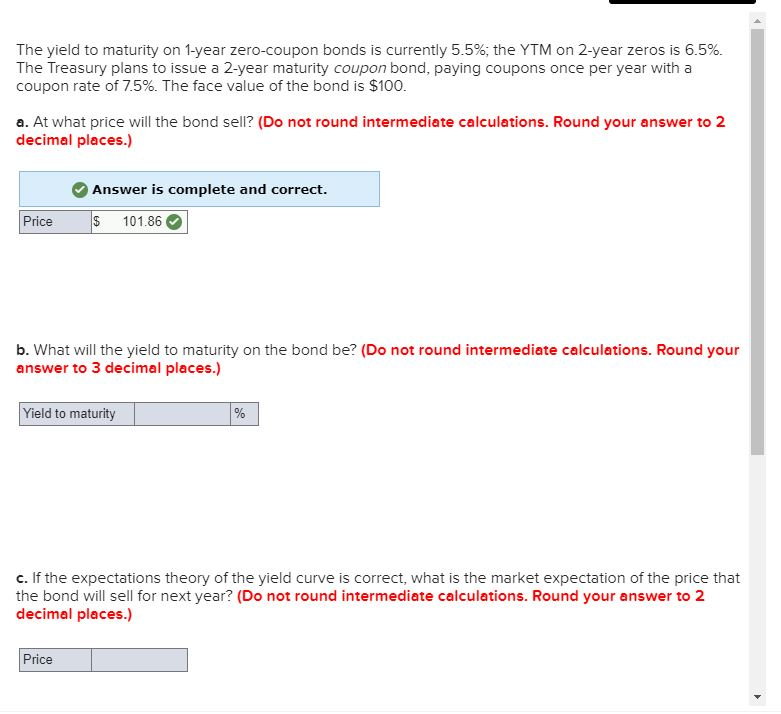

Consider a coupon bond that has a 900 par value and a coupon rate of 6 %. The bond is currently selling for 860.15 and has two years to maturity. What is the bond's yield to maturity (YTM)?

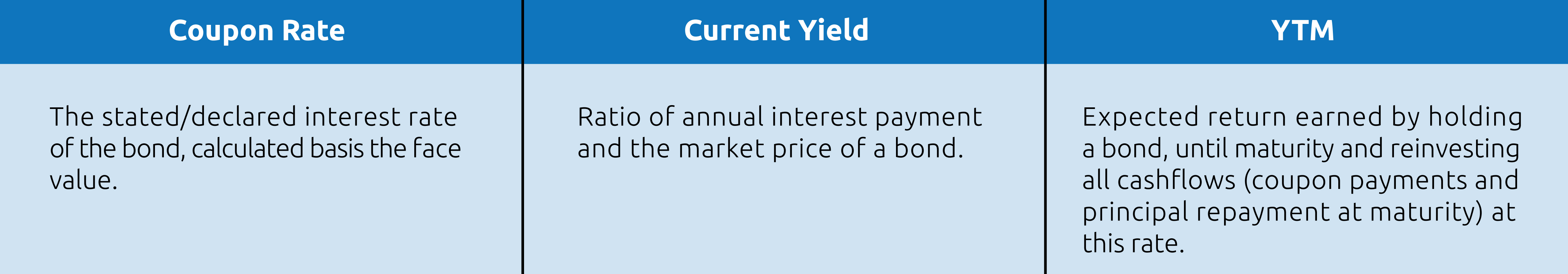

Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

What is YTM in bonds? - Fintrakk YTM will be 90/950= 9.47%. Scenario-3 ( At a Premium) If you purchased the Bond at a premium of Rs80 of the face value of Rs 1000, having a coupon rate of 9% and maturity of 1 year then the yield will be, Interest received= Rs 90 Purchase price= Rs 1080 YTM= 90/1080 = 8.33%.

Yield to Maturity (YTM) of an annual coupon bond - YouTube Learn how to calculate yield to maturity (YTM) of an annual coupon bond. @RK varsity

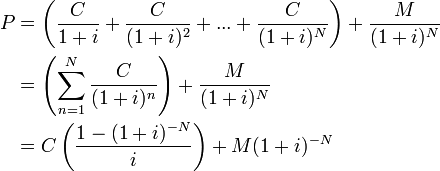

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow The coupon payment is $100 ( ). The face value is $1,000, and the price is $920. The number of years to maturity is 10. [2] Use the formula: Using this calculation, you arrive at an approximate yield to maturity of 11.25 percent. 3 Check the validity of your calculation. Plug the yield to maturity back into the formula to solve for P, the price.

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Annual YTM will be - Therefore, the annual Yield on maturity shall be 4.43% * 2, which shall be 8.86%. Option 2 Coupon on the bond will be $1,000 * 8.50% / 2 which is $42.5, since this pays semi-annually. Yield to Maturity (Approx) = (42.50 + (1000 - 988) / (10 * 2))/ ( ( 1000 +988 )/2)

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Yield to Maturity (YTM) Calculator Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond. This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity.

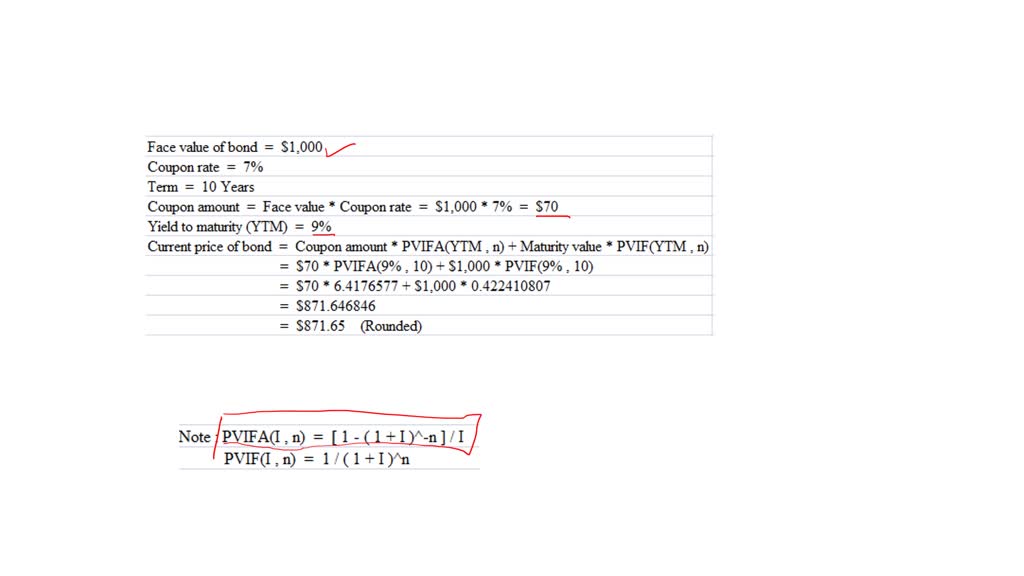

Bond Prices WMS, Inc., has 7 percent coupon bonds on the market that have 10 years left to maturity. The bonds make annual payments. If the YTM on these bonds is 9 percent, what is the current bond ...

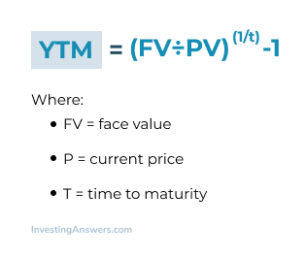

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate.

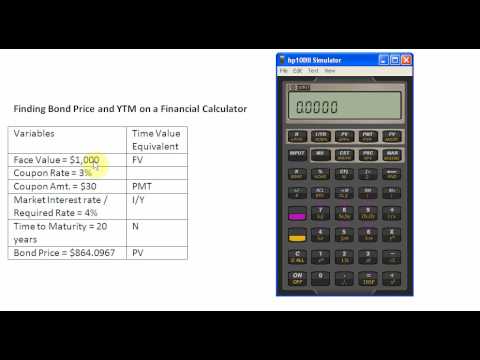

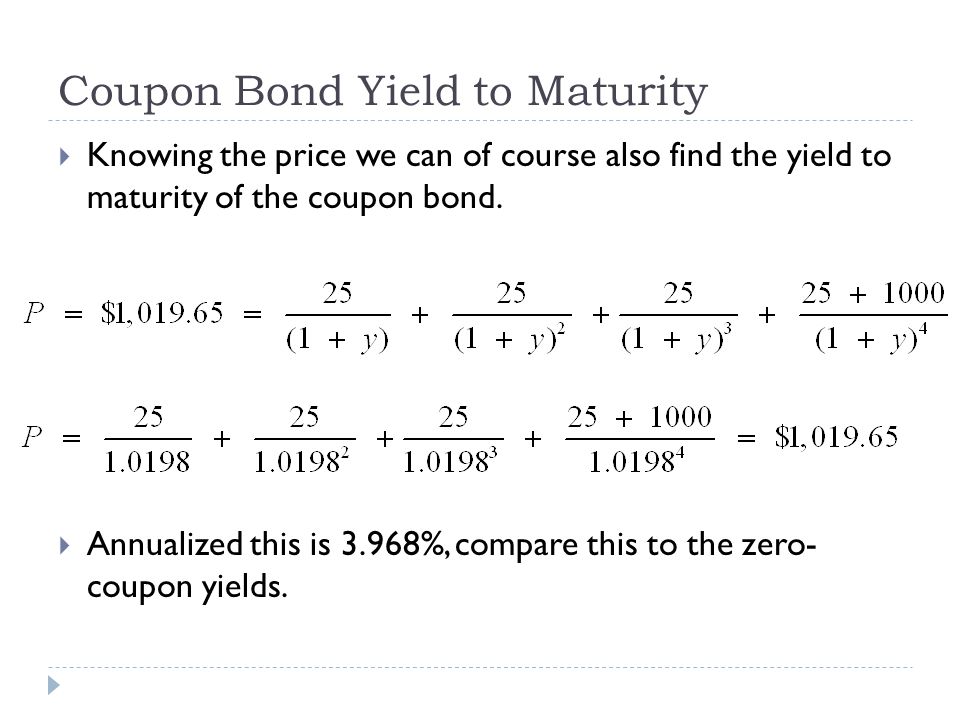

Calculate the YTM of a Coupon Bond - YouTube This video explains the meaning of the yield to maturity (YTM) of a coupon bond in the coupon bond valuation formula and how to calculate the YTM using a financial calculator. Show...

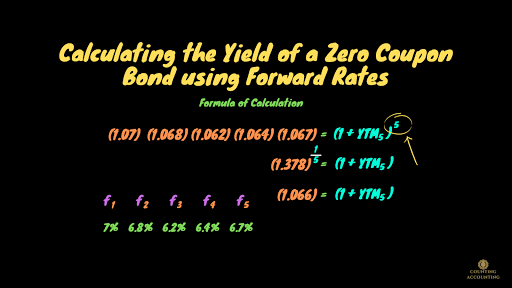

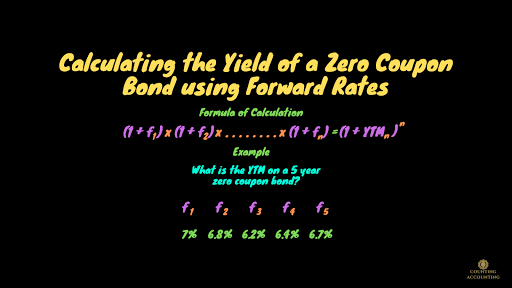

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Ytm Of Coupon Bonds - bizimkonak.com Understanding Coupon Rate and Yield to Maturity of Bonds. CODES (1 days ago) Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The …

Bond Yield to Call (YTC) Calculator - DQYDJ Coupon Payment Frequency - How often the bond makes coupon payments. Bond YTC Calculator Outputs. Yield to Call (%): The converged upon solution for the yield to call of the current bond (the internal rate of return assuming the bond is called). Current Yield (%): The simple calculated yield which uses the current trading price and face value ...

Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Post a Comment for "44 ytm for coupon bond"